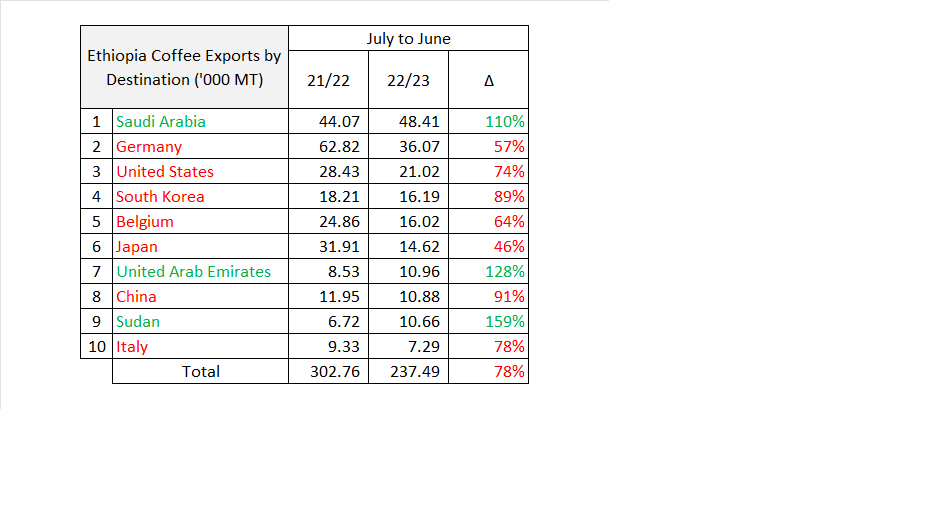

Analysing Export data and destinations of Ethiopian Coffee Exports from the last 2 years, we can clearly see that the quality issues over the last few months have resulted in some destinations gaining and others losing market share. Saudi Arabia is now the top destination for Ethiopia, with Germany (previously top dog) dropping to second place. Interestingly, Saudi Arabia, UAE and Sudan are the countries among the top 10 destinations with increased volume. More traditional destinations such as Germany, Belgium and Japan have reduced imports drastically. Overall shipments decreased by 1 Million bags reflecting lower availability and the struggle to find a market for very poor quality current crop coffees.

Trading continued slow this week, there were 2 holidays on Wednesday and Thursday, furthermore terminal market dropped 11 cents week on week with Minimum Registration Prices decreasing much less, between 5 and 1 cent/lb. There will be few buyers for Grade 5 at plus differentials!

The harvest is progressing well, lower growing areas of Tepi, Benchi Maji and Bebeka are all harvesting. Limu will start within 2 weeks, cherry prices are approximately half the price paid last year. Washing stations owners had their fingers burnt last season, so sticking to prices between 20 and 25 birr/kg cherry. In addition less liquidity means there is less cash in the field, as a consequence competition is much lower even if farmers are resisting the lower prices. All this is good for Natural Grade 5 availability in 2024, crop is good and the proportion of Naturals will be big. Weather wise, there are no concerns.

Birr 55.20 = USD 1

Have a good weekend.

Leave a Reply

Want to join the discussion?Feel free to contribute!