We mentioned last week that container availability in Addis was a concern, disrupting planned shipments. This week, most of us have seen pictures of a huge 400 metre long container vessel stuck across the Suez Canal this week, blocking vessels from entering (in case you haven’t below is what it looks like). Shipping lines have been quick to inform customers of the situation and warning of delays. So here we go, expect delays, on top of the usual delays and most likely increased costs…

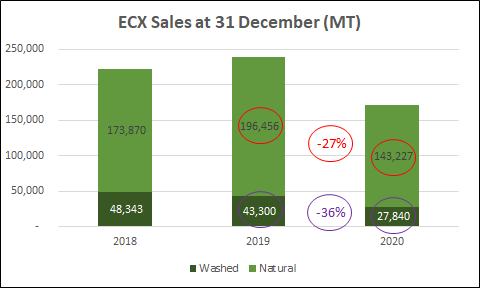

ECX Sales January to December were down from 240 k MT in 2019 to 171 k MT in 2020 a drop of nearly 30%; the graph below shows this broken down in Naturals and Washed coffees (for the 3 year 2018, 2019 and last year 2020):

Export figures support a drop in availability of coffee between 2019 and 2020; July to Feb (8 months) exports 19/20 = 167 k MT and 20/21 = 119 k MT a drop of nearly 30%. Of course we would need to consider variations in stocks and volumes traded outside ECX (Vertical Integration, Farm Exports and Coop Exports) however it is uncanny that the decrease in numbers of ECX sales and Exports are by the same proportion. If we take this extrapolation a little further we can state that the crop decreased by around 25-30% from 18/19 to 19/20 !?!

Forex Birr 41.06 = USD 1

Have a good weekend.