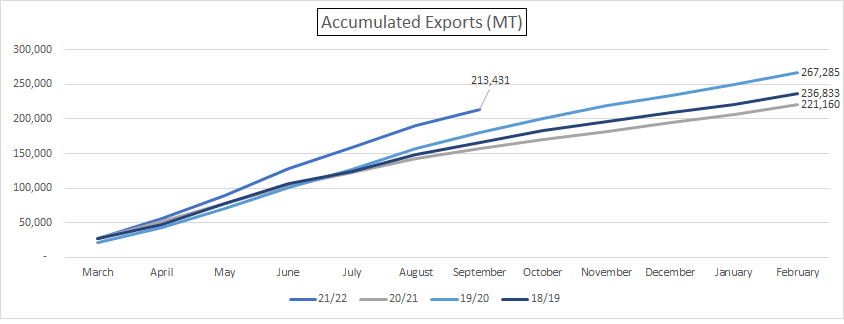

The period March to September was frenetic with huge shipments, many logistical challenges and mired with the pitfalls of trading in a rising market. The waters are much calmer now, with little to offer shippers are focusing on readying the most recent sales and laying the ground for the upcoming crop. There is much to prepare, the ECX became a secondary market to Direct Buying from agrabes in 20/21 and the number of shippers exploded into the hundreds. Our pool of suppliers has mushroomed as a consequence, we have bought from dozen of shippers that had not exported a bean of coffee until this season. It has been a steep learning curve for us and our suppliers.

The next crop appears a tad delayed but we are still expecting a good crop in most growing areas. We are working on our crop report 21/22, but have to admit that the current instability in the country is posing many difficulties to travel and to properly carry out surveys.

Fighting in the North of the country continues, however it is very difficult to get accurate reports on what is happening on the ground. Both sides state that they are open to talks but there is little evidence to suggest that this will happen anytime soon.

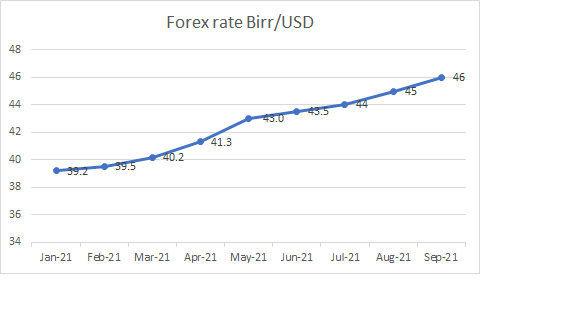

Birr 46.93 = USD 1

Have a good weekend.