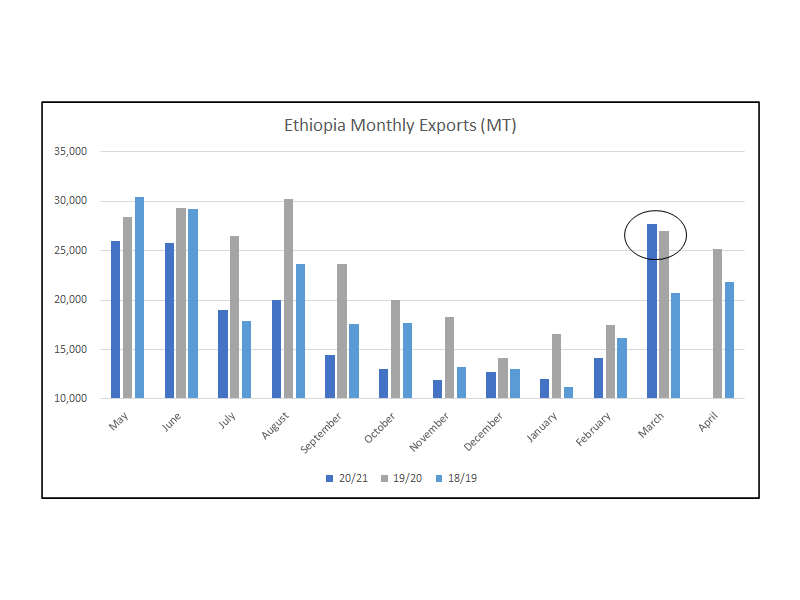

Today is Good Friday and this is Easter Weekend in the Ethiopian Calendar. The shortened working week saw a lot of activity, with the terminal market once again rallying to new heights selling opportunities were abundant for Ethiopian shippers; while some already struggling to cover previously established shorts are abstaining to offer, those that have been accumulating stocks saw continuous opportunities to sell. Grade 5 and Grade 4 coffees traded above Minimum Registration Prices at very attractive differentials (for buyers), overseas buyers (trade and roasters) bought at the most attractive differentials seen in a very long time! Busy times ahead and quite possibly some worrying times for those that had not counted on such a rapid and strong move upwards. Sourcing coffee at ECX has become difficult as the volumes channeled through the exchange are small, agrabes are very much preferring to sell through Vertical Integration, although this channel is likely to become more like Private Treaty as middlemen hunt for the best price among eager to buy shippers.

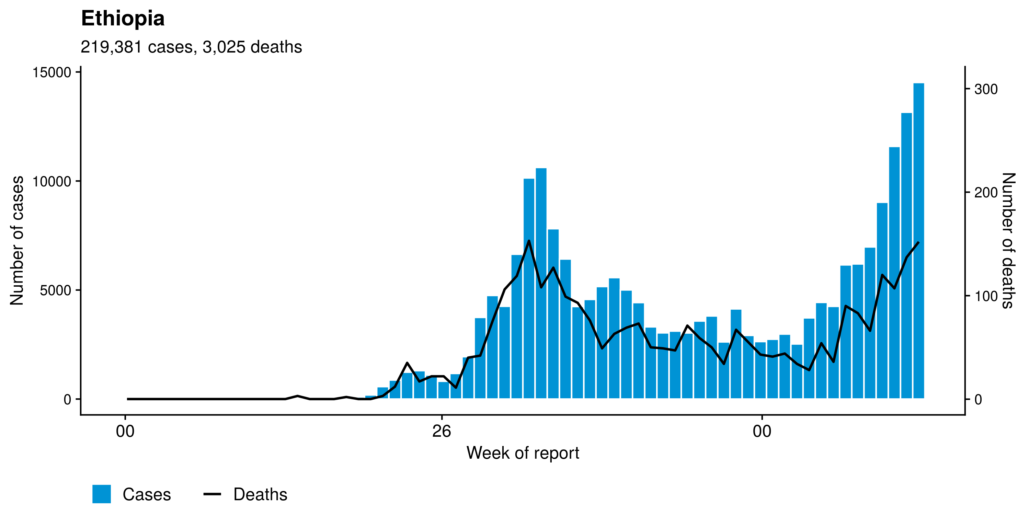

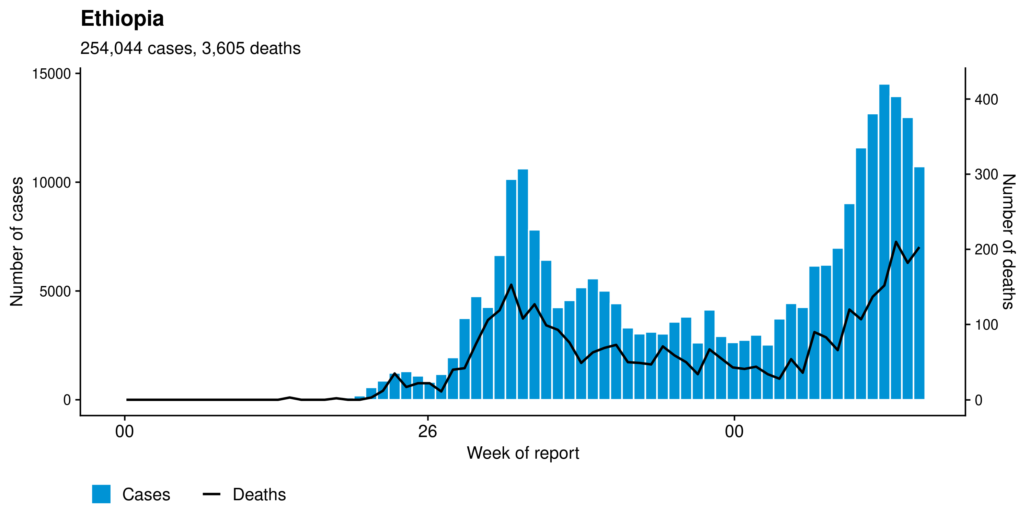

Reported Covid cases have been declining in recent weeks a cause for optimism, as it appears that the pandemic is not running out of control, below the weekly stats since January 2020:

We continue to read reports of ethnic conflict in Amhara Region, in areas with diverse ethnicity. It would seem that having united behind the Government to resolve the conflict in Tigray, different ethnic groups are now airing their grievances in areas of the country that are ethnically diverse. Some reporters have suggested that these clashes could force a postponement of the June polls.

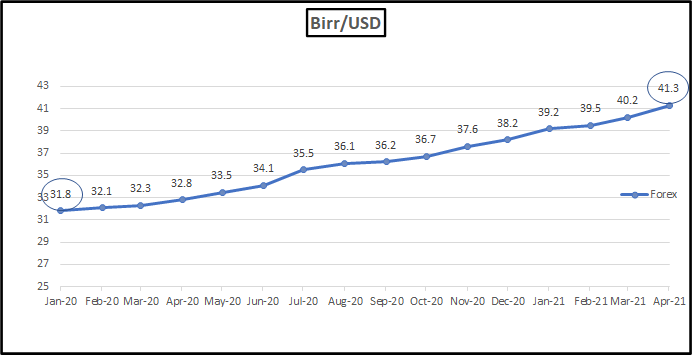

Forex Birr 41.95 = USD 1

Have a good weekend.