All

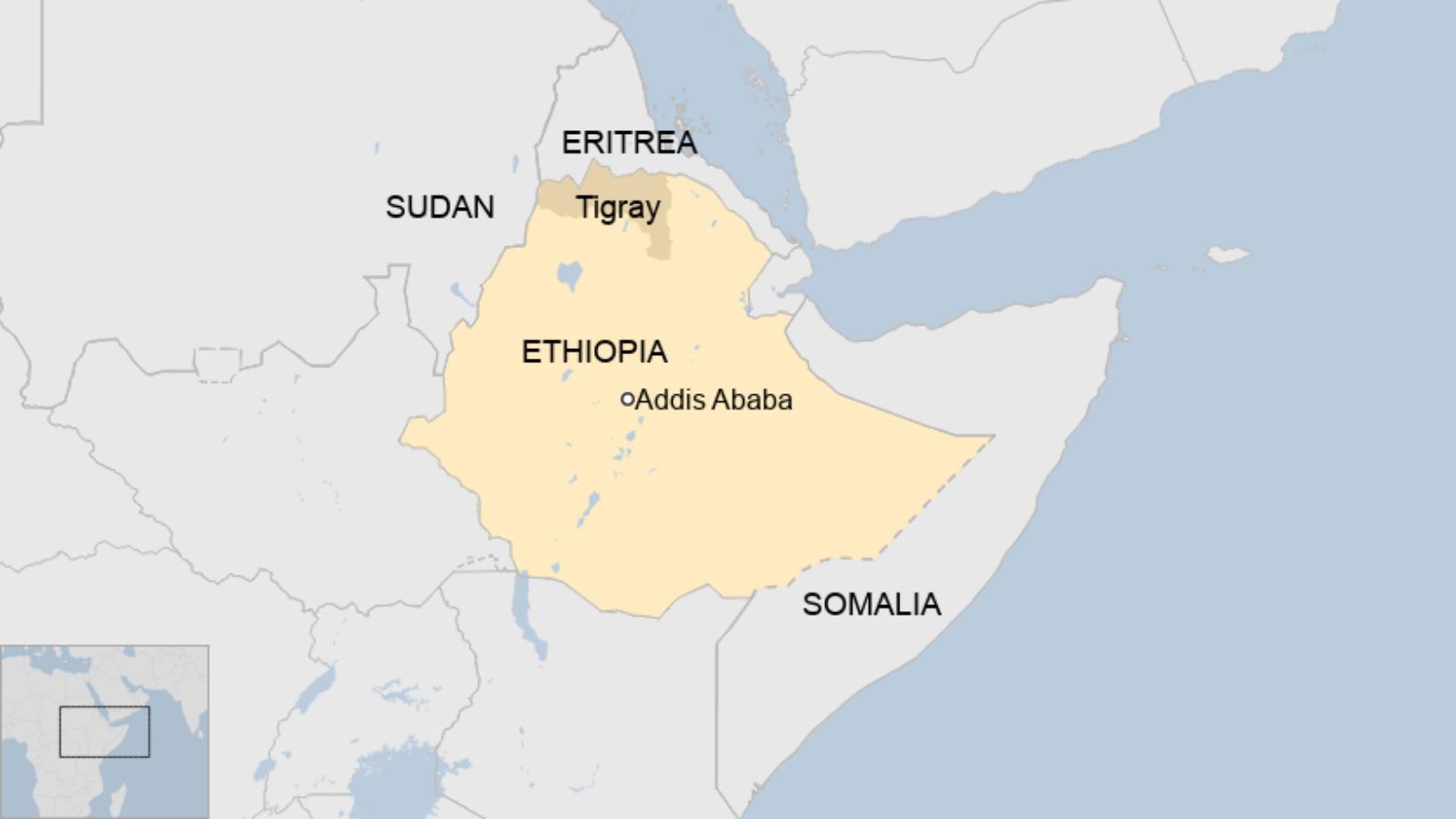

The situation in the Tigray region of Northern Ethiopia is worrying world leaders that expressed concern about the conditions of the civilian population and many refugees mostly from Eritrea. There have been several reports of Eritrean Army excursions into Tigray in recent weeks that have targeted the vulnerable residents of the region. The Ethiopian authorities deny that there is any Eritrean involvement, however we know that early on in the armed struggle between the Ethiopian Army and the Tigray Peoples Liberation Front (TPLF) fleeing National Army soldiers took refuge in Eritrea and that Eritrea has weighed in on the side of the National Government shelling Tigray from position in Eritrea. With several Tigray leaders now arrested or killed during the conflict, the region is at the mercy of National Government and its friends. Humanitarian aid is desperately needed as hunger has set in among the local population.

Meanwhile the Minimum Registration Price for Washed coffees has finally come off this week, declining 20 cents per lb for Yirgacheffe2 and Sidamo 2; prices are still too high to attract a rush to buy and register sales but at least it is a step in the right direction. Exports normally increase in the first few months of the year and this sort of measure will certainly help to boost business.

Birr 39.40 = USD 1

Have a good weekend.