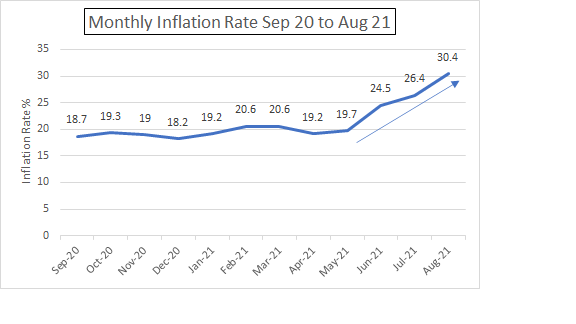

We have been reporting in the last couple of weeks on the downward turn that the Ethiopian economy seems to have taken in recent months. The Government this week has taken some measures to restrict liquidity and try to tackle inflation. The National Bank of Ethiopia (NBE) increased the base rate from 13% to 16%. Additionally, commercial banks require to up their deposits with the NBE from 5% to 10%.

The Government also announced that exporters will only be granted (for imports) 40% of the value in U.S. Dollars that they export, it was 70% until yesterday. We are not entirely sure of the impact of this squeeze on liquidity, however it is now harder for those shippers that rely on the USD proceeds from coffee exports to finance their import business, and therefore there will be less imports.

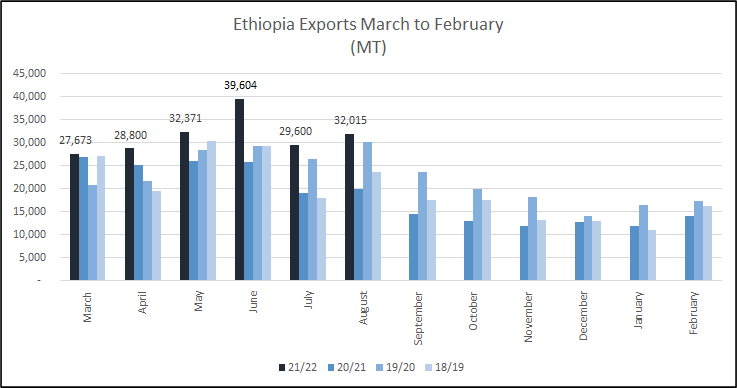

The worsening economic outlook has negatively impacted imports and the number of food grade containers arriving in Addis. If fewer containers are imported, then fewer containers are available to load coffee for export… As a consequence, despite a seasonal reduction in shipment pressure, it has become harder to find containers to load coffee for export. Average waiting time for containers has gone from 2 weeks to 3 weeks and we believe this is likely to worsen since imports are likely to decline further.

What will the Ethiopian Government do with increased proportion of USD that now has to be transferred to NBE? Resupply the army or buy much needed food and other first necessity goods? We hope for stability and prosperity, for the BBC assessment on what it is like to go about your daily life in Ethiopia these days, please follow the link: https://www.bbc.com/news/world-africa-58319977

Offers from shippers are few and far between, prices are all over the place, it really feels that coffee stakeholders are uncertain about what to do and where things are going. Meanwhile the next crop is coming along nicely, weather (so far) has been favourable, leading us to believe that the crop will be a good one, both in terms of quantity and quality. The coming 3 months will be crucial, in terms of weather and political stability, to insure that 2022 exports fulfil expectations and surpass 2021.

Forex Birr 45.57 = USD 1