Coffee is not changing hands, stakeholders with coffee stocks, whether farmers, middlemen or exporters, are sitting on them! Why is this happening? In 2 words: Finance and Price.

Shippers that own expensive Washed parchment that has tied up their cash, cannot find an overseas buyer willing to pay 100 over plus. In an environment of high prices, restricted access to finance and stocks that are not moving, shippers are finding themselves paralysed. There will be a quantity of washed Grade 2 coffee sold above 350 c/lb FOB and this coffee is getting shipped. However, the price paid to farmer for cherries is higher than what is currently achievable in the FOB market, as a consequence trading has ceased. It is clear to us that overseas buyers of Washed qualities are looking to buy, however not ready to pay the shippers asking prices.

Shippers that are short Naturals (Grade 4 and 5) at below 200 c/lb FOB cannot cover from local middlemen without incurring substantial losses. This last point is supported by current asking prices for Grade 5 prices between 215 and 220 FOB Djibouti LC (Grade 4 at 240 c/lb). In the lower grade space (Grade 4 and 5) there are delays in shipments as exporters struggle to cover sales registered in February (at what now look like very good prices) because middlemen had got used to ever increasing coffee prices. Agrabes and farmers are in for big shocks, the market will not pay the expected prices, and as much as the Birr is expected to devalue vs the USD, the decline will most likely be slow and steady. For now stock holders of Naturals will wait to sell, time is on their side, after all we are in March and very little of this crop has been shipped so far.

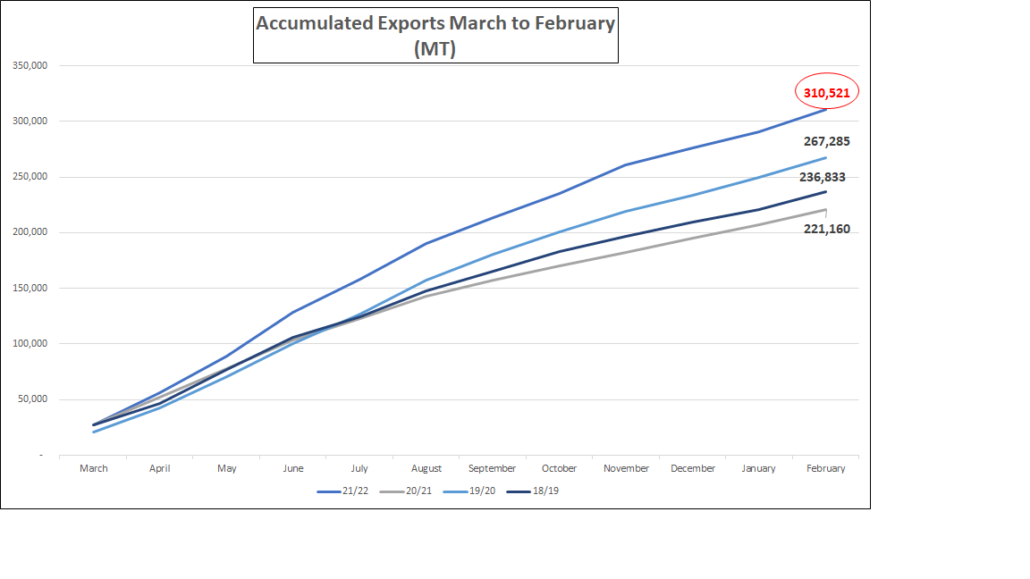

There are stocks at processing mills in Addis but shipments in March and April will most likely be lower than we could otherwise have expected were it not for the scenario outlined in the previous paragraphs.

Birr 50.95 = USD 1

Have a good weekend.