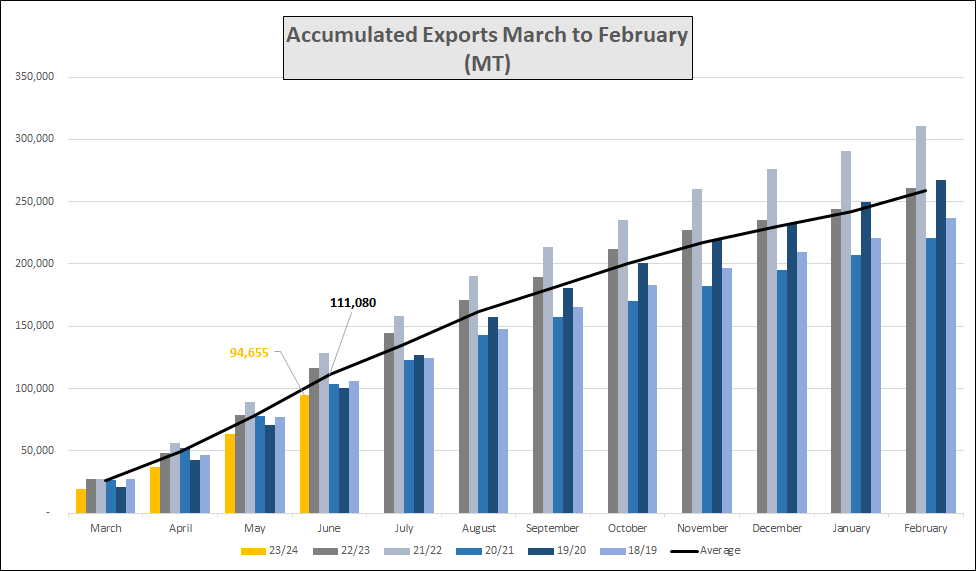

June export figures just fell shy of 31 K MT; at first glance the figure seems fairly good, granted lower than the June shipments for the past 3 years but at least above 30 K MT; however, as we can see below, the path is clearly for lower shipments this season vs last which if it materialises will be a break in the off/on cycle. The Saudi market has gained weight as a destination for Ethiopian coffee, a sign that quality is currently more geared to middle eastern markets that the more customary destination of Europe, Japan and the USA.

New business is at a standstill, exporters do not want to buy from agrabes having had their fingers burnt with poor quality deliveries. Overseas buyers cannot pay the minimum registration prices, +120 for Sidamo 2, +60 for Limu 2 and around level money for both Grade 5 qualities. In any event quality is major concern so buyers prefer to wait than risk owning quality that they will not be able to move later.

The weather has been a little drier this week which has helped to move coffee from the growing areas to Addis, we are starting to see more pre-shipment samples as a consequence. However, shipments continue to be very delayed.

Birr 54.67 = USD 1

Have a good weekend.