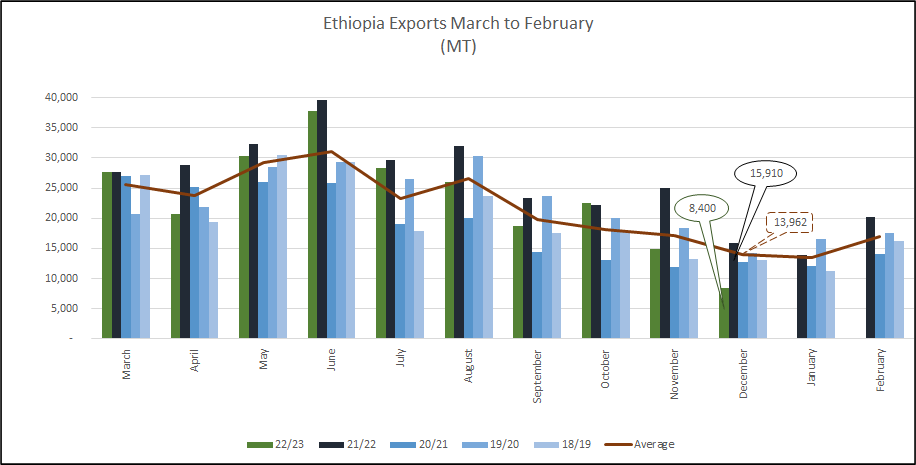

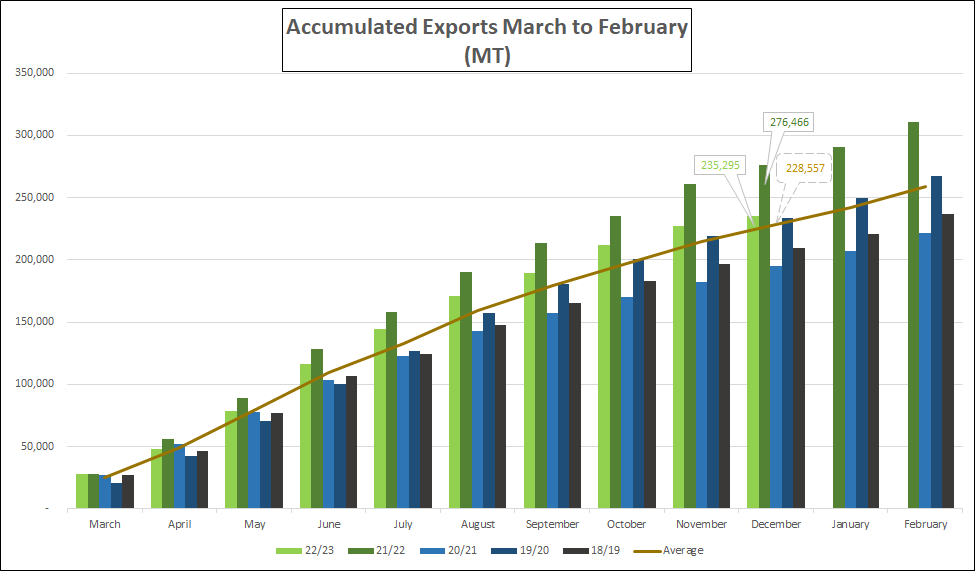

Faced with very few export registrations, pressure from Government and shippers (holding unsaleable stagnant old crop stocks), the Coffee & Tea Authority (C&TA) finally relented and reduced substantially Minimum Registration Prices for past crop coffee. Will these reduced prices allow for the these stocks to finally get shipped? We shall see. New Crop prices remain untradeable for now, give it a few weeks and pressure will mount on the C&TA to set Minimum Registration Prices at realistic levels. At present, the focus is on shipping the remaining stocks of old crop in the hands of exporters, however from February onwards the C&TA will start worry about the small number of New Crop Registrations.

OLD CROP Minimum Registration Prices (usc/lb FOB Djibouti):

17th January 24th January

Yirgacheffe 2 240 228

Sidamo 2 233 221

Limu 2 182 173

Sidamo 4 169 158

Lekempti 5 152 138

Djimmah 5 152 138

NEW CROP Minimum Registration Prices (usc/lb FOB Djibouti):

17th January 24th January

Yirgacheffe 2 301 301

Sidamo 2 292 292

Limu 2 233 233

Sidamo 4 189 189

Lekempti 5 168 168

Djimmah 5 167 167

Meanwhile it seems that some importers have been very disappointed with quality of 2022 arrivals. These have resulted in quality claims and friction between seller (shippers) and buyer (trade). These problems will overhang New Crop business and considering the reduced contracts for the New crop, does not bode well for a smooth offtake of the New Crop. Buyers will be cautious when engaging with shippers, requiring more assurance that contracts will be fulfilled, i.e. correct quality shipped in a timely fashion. Continuously being let down by shippers is not the right environment for traders to commit…

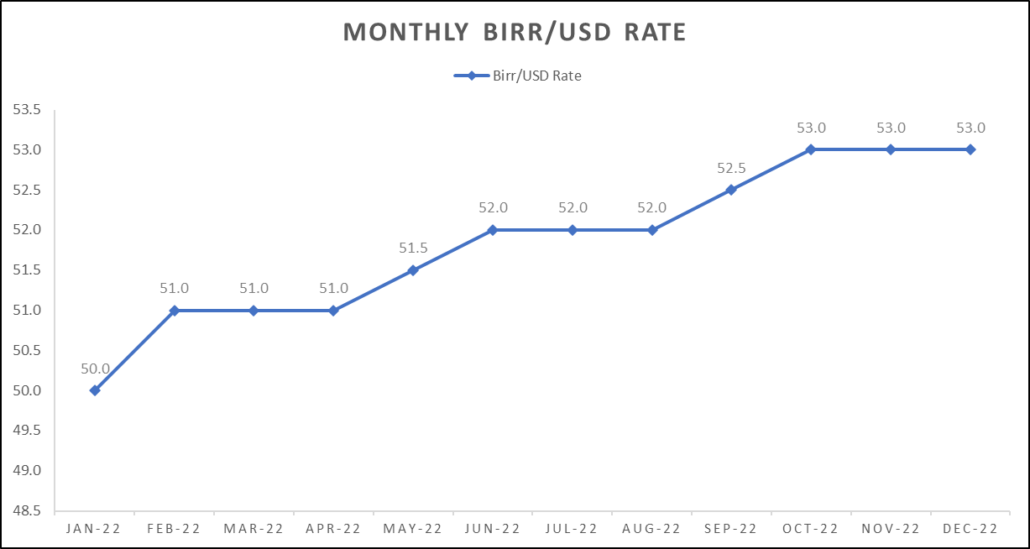

Birr 53.46 = USD 1

Have a good weekend.