This week the Prime Minister appointed a new Governor for the Central Bank, we look at a couple of rates that are of particular concern for Ethiopian Coffee Stakeholders and the Government.

Much of our trading activity in Ethiopian coffee is directly influenced by 2 factors, Inflation and Forex rates. This week’s commentary will focus on these 2 rates, how they have performed, expectations for the coming months and implications for coffee prices and flow from grower to the export market. Both these rates are interconnected and it seems that Government concerns about the Inflation Rate (difficult to control with policy) is influencing the setting of the Forex Rate (controlled by the Central Bank). Firstly, Forex Rate.

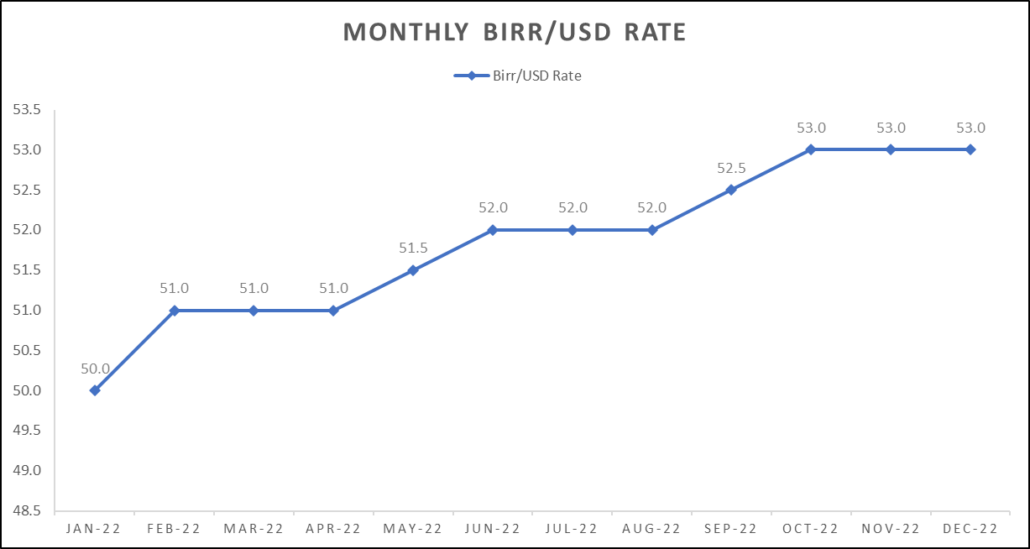

2022 started with the Birr trading at 50 to the USD and ended the year at 53; a 6% devaluation over the 12 month period. On the face of it, it would appear that the Ethiopian currency fared well, however currency movements are controlled by the Central Bank and when we consider that the Black Market rate a different picture emerges. Rumours of Birr devaluation have been persistent in the past few weeks, however these have remained only rumours and some shippers have given up on waiting for the Government to adjust the value of the local currency and are basing their business decisions on current forex levels. The effect of uncertainty regarding the forex rate has kept shippers from registering export sales, coupled with unrealistically high Minimum Registration prices means that export registrations at extremely low. As mentioned last week, December shipments slumped, sharply down on November shipments and vs December 2021 exports; in January and February we also expect reduced exports.

Turning to the Inflation Rate.

The year started with an Inflation rate of 34.5% pa and ended just slightly lower at 33.8% pa. Although Inflation rate is stable in the mid-30’s, this is a fairly elevated rate and the main impediment for the Government to loosen the Forex rate. Donor government and agencies continue to pressurise the Government to take a more liberalised approach to Forex controls that would enable to official rate to get closer to black market rates, however fearful of a steep rise in Inflation the Government is resisting. Farmers rationale for demanding high prices for cherry during the recent harvest in anchored on current inflation rates, if the price for everything is going up so should coffee…18 months ago inflation was below 20% at current 34% levels farmers are feeling the pinch.

Birr 53.43 = USD 1

Have a good weekend.

Leave a Reply

Want to join the discussion?Feel free to contribute!