Yes, for all the wrong reasons, following months of being out of the limelight Minimum Registration Prices (set weekly by the Coffee & Tea Authority) once again become relevant and will act as an impediment to trade unless revised to reflect the sharp decline in the terminal market in past the 2 weeks. Tuesday’s (25th October) published minimum prices FOB Djibouti:

- Yirgacheffe 2 268 usc/lb

- Sidamo 2 260 usc/lb

- Limu 2 203 usc/lb

- Sidamo 4 197 usc/lb

- Lekempti 5 180 usc/lb

- Djimmah 5 179 usc/lb

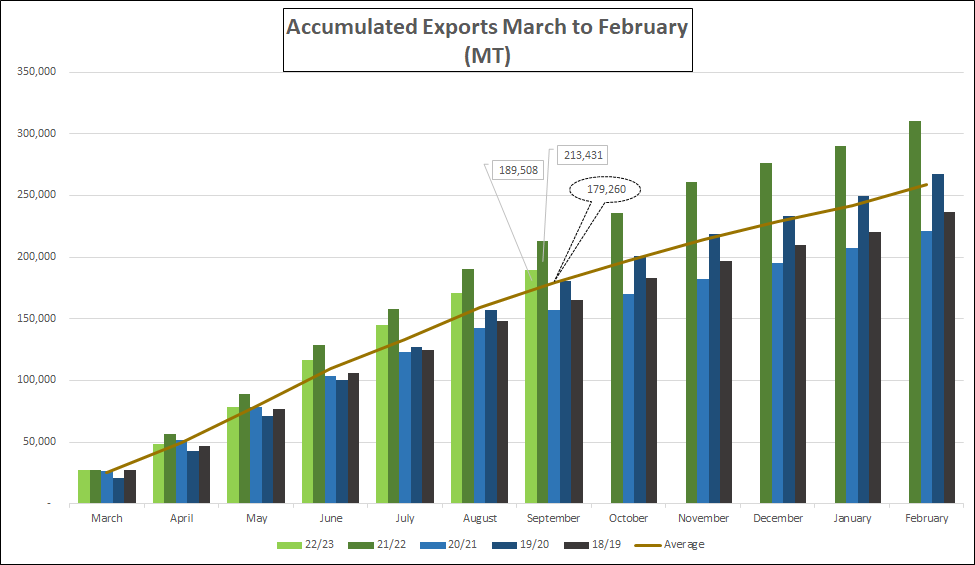

Needless to say trading is at a standstill (particularly Grade 5) at a point where the Government is pressurising shippers to export the remaining volumes of the 21/22 Crop since the 22/23 Crop is upon us. Meanwhile cherry prices paid by agrabes in the areas where the crop is currently under harvest range between 51 and 63 Birr per kg, this translates into a price above 300 usc/lb at farmgate level. It is difficult to see how the crop can be marketed profitably unless a significant devaluation occurs between now and when the crop is commercialised. The context we are faced with this season contrasts with last, the coming crop is much larger and additionally there is a worldwide economic crisis looming, therefore the prospects for buoyant demand are dim. From the perspective of an agrabe, you would rather have coffee than cash, coffee has increased in value over the past 2 crops; it can also be turned into USD which is a hedge against any potential devaluation of the local currency. The only spanner in the works would be a declining coffee market, which is what we have at the moment (the NY market has lost 40 cents in three weeks). Ethiopian stakeholders need to be cautious, the export price for Ethiopian coffee in 6 months’ time may not meet current expectations. Furthermore, if the Birr does not devalue substantially the expected returns will not materialise.

Following reports of increased fighting in Tigray region and Government troop advances in that part of the country, some hopeful news of peace talks emerged this week: https://www.bbc.com/news/world-africa-63384278 and for more commentary: https://www.bbc.com/news/av/world-africa-63406979

Birr 52.86 = USD 1

Have a great weekend.