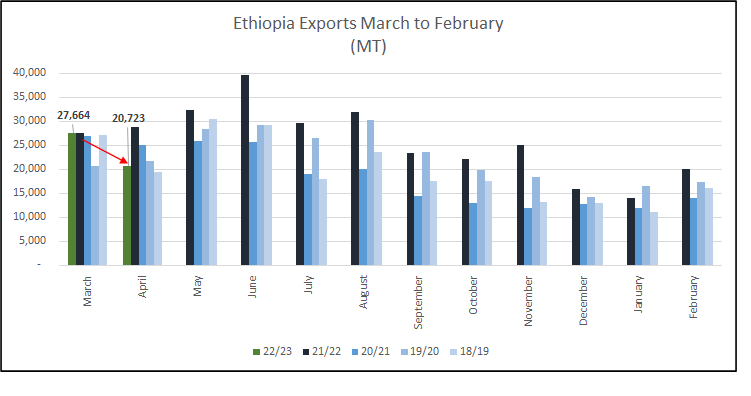

After the excitement of a week where prices seesawed on fears of a frost and the realisation that there was no frost, trading in Ethiopia settled down to a more lethargic stance. Many shippers sold as the market approached 230 c/lb but retracted as the market tumbled. Liquidity issues forced the hand of some Washed Arabica long holders into accepting below asking prices and the same can be said for some stale Grade 5 stocks that were released. As the NY market again rocketed on Thursday shippers increased their offer prices in the expectation that it would reach higher levels. Business activity is slow, shippers are still weighed down by high priced stocks, difficult logistics and tight replacement prices. Demand is only sporadic and thin.

On a FOB basis, Grade 2 from the South is above +100 and Grade 5 at -25, Grade 4 are trading at plus double digit differentials.

Ethiopia’s Tedros Adhanom Ghebreyesus has been re-elected as the World Health Organization’s (WHO) head for a second five-year term. https://www.bbc.com/news/world/africa?ns_mchannel=social&ns_source=twitter&ns_campaign=bbc_live&ns_linkname=628cfcbb4259031cb5a2510b%26Ethiopia%27s%20Dr%20Tedros%20re-elected%20as%20WHO%20head%262022-05-24T16%3A07%3A10.089Z&ns_fee=0&pinned_post_locator=urn:asset:6e0f2c80-1e1a-41da-b022-c44862126a24&pinned_post_asset_id=628cfcbb4259031cb5a2510b&pinned_post_type=share

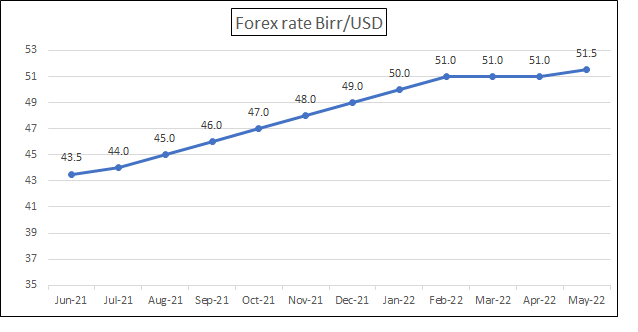

Birr 51.55 = USD 1

Have a good weekend.