This week the NY market had quite a trading range due to recent weather concerns that never materialised into a serious problem. In this “yo-yo” environment trading is quite frustrating for all, however some business did materialise. Some exporters took the opportunity to sell has the terminal market rallied however a fair amount of business was left undone as the market tumbled in the later part of the week. On a more positive note much more coffee is getting loaded and moved to the port giving hope that this months shipments will supersede April’s poor performance. We expect that the business concluded this week will release some of the space pressures on mills and that throughput will accelerate in the coming weeks. Differentials for Grade 5 at around -25 FOB CAD and Washed coffees from the South attracting differentials well in excess of +100.

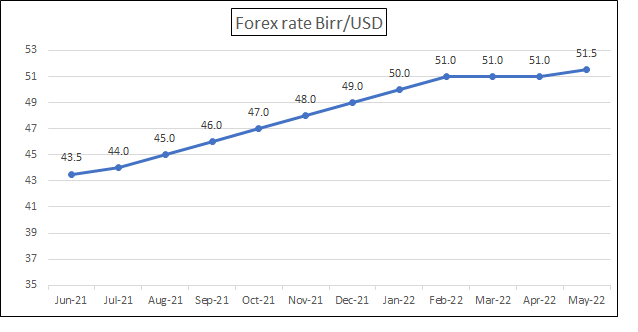

The forex rate has been very stable in recent months. The pace of devaluation has slowed down considerably, could it be that the demand for USD has also slowed down? Coffee exports have been at record levels in terms of USD and MT, with the July to April period exceeding USD 1 billion in value; coffee is the biggest foreign currency earner and with the economy slowing down, is the demand for USD lower? I would be surprised that the demand for hard currency from business has decreased but then again, everything is possible…

Forex Birr 51.51 = USD 1

Have a good weekend.

Leave a Reply

Want to join the discussion?Feel free to contribute!