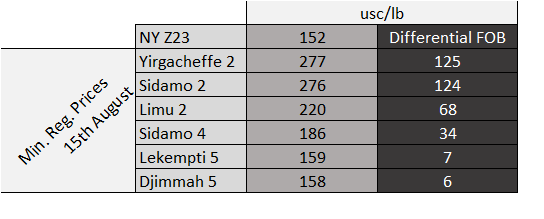

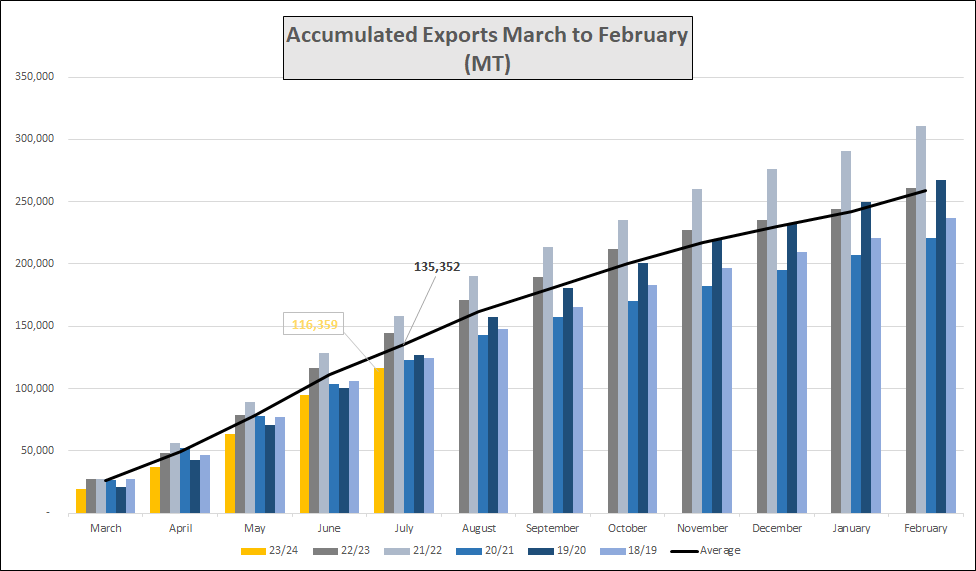

With lots of coffee still unsold of the current crop and the next crop just round the corner shippers seem increasingly willing to sell, however minimum registration prices for Naturals remain high. While there are unshipped contracts registered at higher prices it is unlikely that the Coffee and Tea Authority will reduce Minimum Registration Prices fearing that overseas buyers will default on existing contracts to replace with cheaper purchases. As a consequence new contract registrations remain at a low level and exporter figures in the coming weeks and months will reflect this. The positive side arising from low levels of business at current prices is that it will push stakeholders to buy new crop cherries at more realistic levels than what was paid last year.

In lower lying areas of Teppi, Bebeka and Djimmah the harvest will start in early September. Generally, we are expecting an early crop this year as a consequence of above average rainfall during the maturation and ripening of the crop.

Shippers that have non performing bank loans have been warned that they could have face higher interest rates of as much as 22%, hopefully this will incentivise exporters to only purchase good quality coffees since poor quality is increasingly rejected by overseas buyers, becoming “sticky” and costing more to finance. In any event, given the extremely poor quality of the 22/23 crop, 23/24 can only be better, speeding up the flow from farm to ship.

Weather has become drier in the past few weeks, this is beneficial to lower moisture levels of current crop coffee stocks. Furthermore, as the new crop begins to be processed sunnier weather will be needed to dry parchment and naturals alike.

Ethiopia along with Five other countries has been invited to join the BRICS group, which aims to counter balance the weight of the G7 on the world stage.

Birr 55.02 = USD 1

Have a good weekend.