EXECUTIVE SUMMARY

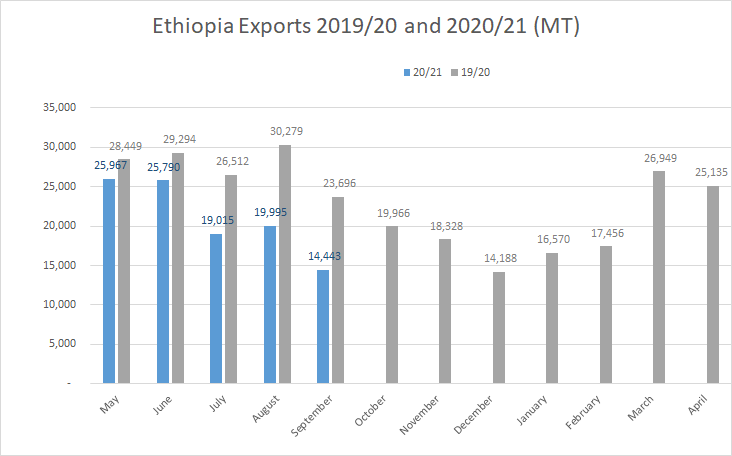

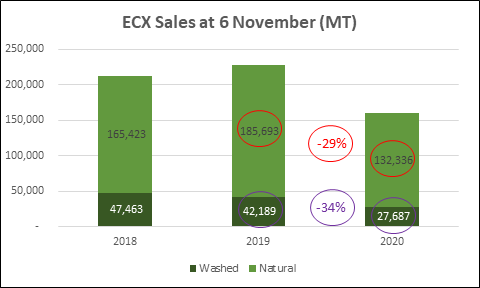

The crop was forecast lower than the previous crop by 5% and ended up being even lower at 402 K MT (we had estimated 411 K MT). Split between Washed and Natural 20% and 80%, due to the sharp decline in production in the South where a higher % of the crop is washed viz-a-viz other producing areas of Ethiopia. We also revised down our carry out stocks by approximately 155 K bags to just over 1 Million bags, which is the lowest carry out stock figure in past few years. The pace of sales at ECX has been very low this 2020 Calendar year lagging behind 2019 by 30% in volume. Exported volumes started to lose pace from July and we expect this trend to continue until 20/21 crop coffee starts to come to market in earnest (from December onwards at ECX and March onwards FOB). Quality has also been disappointing due to excessive rain during the maturation period and wet weather post-harvest. Sundried qualities had many defected beans (blacks, mouldy and sours) and in the cup the coffee was found to be Earthy, Musty and Phenolic. Exports were consequently also lower than the previous 12 month period by 3%.

We are expecting a greatly improved crop in 20/21 both in terms of quality and quantity. Production is expected about 9% higher than in 19/20; the weather in the last 12 months has been much more beneficial for quality, harvesting started early and the weather post-harvest (so far) has been much more conducive to producing better quality coffee. Particularly Djimmah quality is expected to show big improvements viz-a-viz 19/20. The estimated split Washed to Natural is 19% to 81% reflecting the pick up in production in the more Natural growing areas of the West (Wellega, Illubabor and Djimmah). We also expect more volume of Natural from the South. Notwithstanding the usual political issues that plague this part of the world and the current global pandemic, we expect that the pace of sales from farmers to agrabe and on to the ECX to be constant and steady. The time that Agrabes are permitted to hold coffee unsold at ECX warehouses has been extended from 30 to 60 days which could cause some disruption however increased volumes will pressurize coffee to change hands along the value chain. The harvested started much earlier this year (compared to 2019) and we are already seeing New Crop Washed coffees trading at ECX, in December we expect much more coffee to be available. Cherry prices started from a much higher level this season compared to last. However, these seem to be stable at around 20 Birr/kg Red Cherry.

The introduction of a minimum price caused some disruption to the flow of coffee to Export markets. However, after a few weeks with far too high Minimum prices and consequently no sales registrations, the powers that be, lowered prices and more normal trade resumed. New Crop Minimum registration prices have again been set at overly optimistic levels however we expect that a happy balance will be struck at some point in the coming weeks.

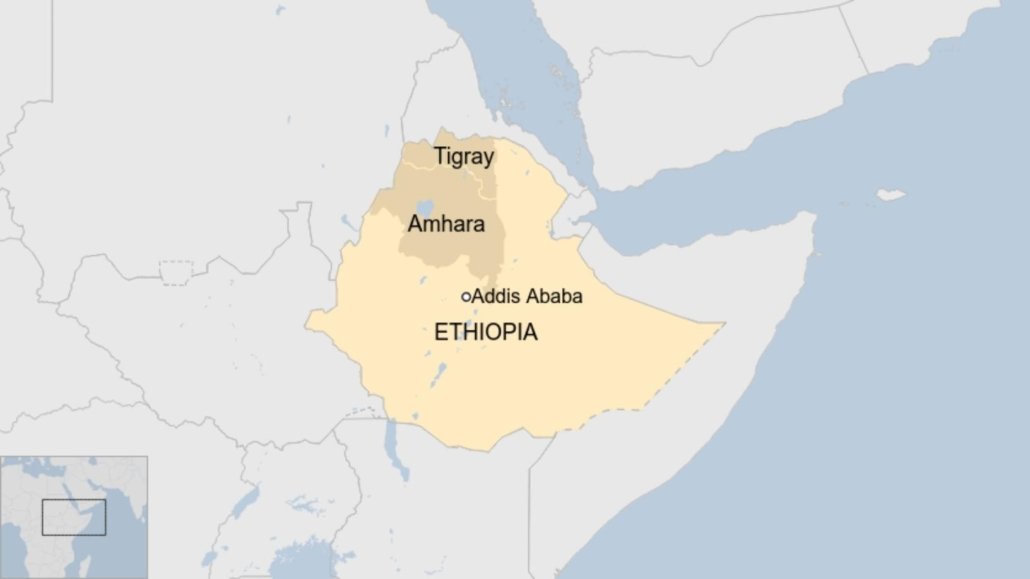

The General Election that was postponed from 2020 to 2021 due to the pandemic is expected in June 2021. We pray for a rapid and satisfactory solution to the current conflict in the North of the country and a peaceful election in the summer of 2021.

The 2021/22 crop is projected, under normal conditions, at 435,277 MT (7.26 M bags) and the weighted production probability is 403,088 MT (6.72 M bags).