EXECUTIVE SUMMARY

It has been a difficult year for Ethiopia, fighting irrupted in November 2020 in the North of the country and spread southwards over the course of the last 12 months. Today the country appears more unstable than it was 1 year ago as other rebel groups aligned themselves to the Tigray Rebels fighting the Central Government and vying for greater regional autonomy in various parts of the country. Insecurity has spread throughout the country, in one way or another, reaching everyone. This has affected the work in the field to collect data to prepare our Crop Report. Insecurity and the pandemic have hampered our ability to travel to the growing areas, so much so, that our report this year is more of a guesstimate than based of tree observation and scientific approach and rigour! We are relying much more on anecdotal evidence and different stakeholder opinions to reach the figures that we layout in this report.

2020/21 Crop

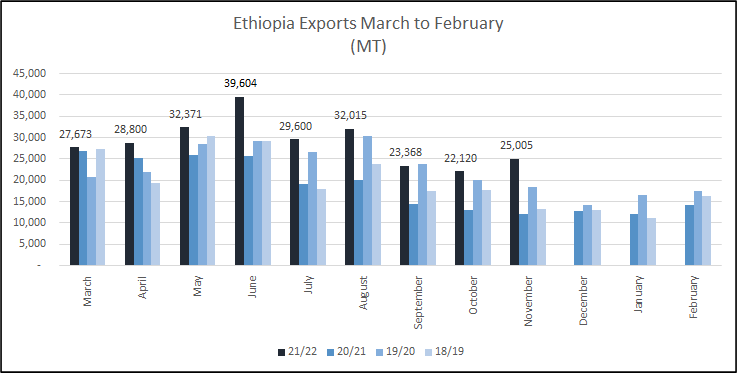

We had estimated a good crop at 439 K MT and we have not changed that figure. However we now estimate that Carry In stocks were higher by 15 k MT than our original estimate, due to the high Exports between March and September 2021. Indeed every month in this period was a record month; shipments surpassed our estimates by over 40 K MT. Shipments in October continued strong surpassing 20 K MT and in November are also likely to be high. As expected there was less Djimmah quality available and more Lekempti and Washed Sidamos. Weather played an important role in the good volumes and excellent quality of the 20/21 crop. We have made any substantial changes to our estimated Internal consumption or stock figures. We also believe that as a consequence of political instability over the past 12 months both Internal Consumption and Unrecorded Exports (smuggling) have decreased; we have decreased our Domestic Use figure by 11,000 MT. Given strong Exports for October 21 and forecast for November our Carry Out figure as of end September 2021 is estimated at 72 K MT.

2021/22 Crop

We are estimating an even higher crop in 2021/22! Farmers are motivated by improved prices and plantations that have been started in the last few years are coming into full production. Greater liberalisation of internal marketing systems (Vertical Integration) which allows for Exporters to negotiate directly with Agrabes and farmers, by-passing the ECX, have improved prices and services. The international market has also played its role in pushing prices up at farm gate level. The move away from ECX to Direct buying through Private Treaty is now the preferred way for coffee to move from the interior to exporter. The number of registered exporters has exploded to over 600 registered exporters as increasing numbers of importers and manufacturers look at coffee export dollars as a means of enabling access to imported goods for their main businesses. We have an On year in areas like Benchi Maji and other “Djimmah” growing areas which are some of the most productive in Ethiopia. Lastly weather has favoured coffee production this year and regions where we could expect the trees to produce less this year are, on the contrary, up. Prices at the start of the harvest are between Birr 30 and 40 per KG of cherry, which is a very large spread (over 70 c/lb), are a consequence of competition. Production is Estimated at 470 K MT for 21/22 a 7% increase on 20/21.