All

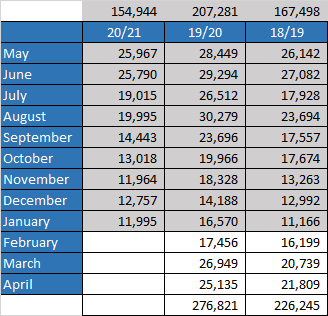

The recent upwards swing in NY has allowed for much selling activity in Addis. It started last week and really took off this week! Some shippers are now well sold and not so eager to offer. We expect that Minimum Registration Prices for Naturals to increase over the weekend. It would seem that we may be in for a more subdued couple of weeks ahead after the recent frenzy of activity. This surge in export registrations has come to the aid of Coffee and Tea Authority officials who were under pressure from Central Government to increase registrations. The World Bank has painted a rather gloomy economic picture for 2021 with a paltry 2% growth forecast, which if it comes to being, will be the lowest growth in recent years.

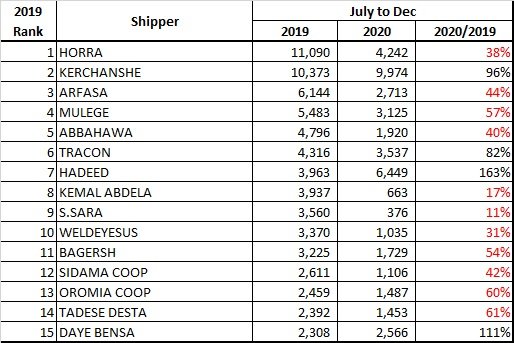

Meanwhile at ECX volumes on offer of lower grades (Grade 5) continue to frustrate shippers. As a consequence, the Vertical Integration craze previously limited to Washed Coffees has spread to Natural supply chains, as larger shippers see too much competition at ECX from small (sometimes tiny) shippers which have mushroomed in the last few months. Likewise overseas buyers are having to expand their supplier network to find the volumes they want to contract.

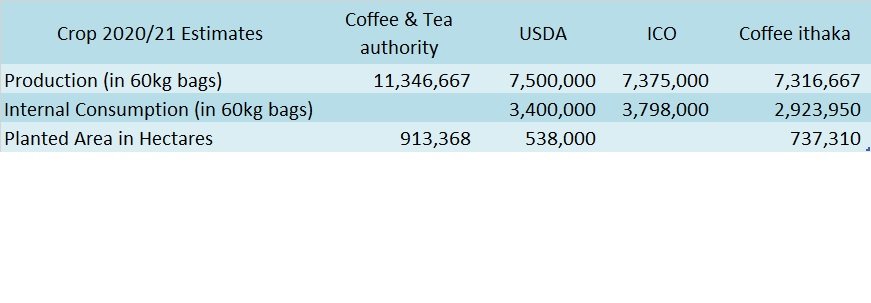

Below we compare some data about the current crop from different sources, interesting to see how some of the figures vary so much:

Birr 39.97 = USD 1

Have a great weekend.

Regards.