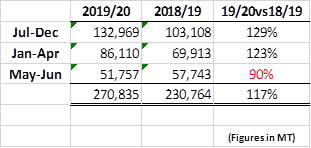

We received the official Export figure for the 19/20 Ethiopia Calendar year (July/June) and below compare these to the previous 12 months:

The total exports for 19/20 reached 271 K MT (4.5 M bags), this is 17% more than in 18/19 and reflects the large crop of 18/19 and the drawdown on stocks that we have previously mentioned. Interestingly when we compare and breakdown shipments for the May/June 2020 vs May/June 2019, these are lower by 10% and reflect the lower 19/20 crop. We expect this trend to continue, as we move forward during the 20/21 shipment cycle, shipments should stay below 19/20; this is a reflection of:

- Lower Crop (particularly in the South)

- Minimum Price limiting export sales

- reduced demand for Forex by importers as a consequence of declining economic growth

- Poor quality of this crop

- Lower differentials for Brazil coffees

As mentioned, registrations have been low and shippers are getting desperate to sell. Some have come up with ingenious plans to circumvent the Minimum price restrictions. Meanwhile, ECX prices remain high on strong demand from the local market which has been starved of coffee as a consequence of the high exports up until April. High internal prices and high number of defects that have to be removed from the raw product to prepare export quality coffee (quality this season is very bad as previously discussed) means that the local market will get well supplied;

Regarding quality problems this year, some shippers have mentioned sorting out 40% of the coffee bought at ECX to prepare export quality coffee. Since internal market (mercato) prices are high (higher than ECX prices) shippers are OK with selling into the internal market the coffee removed during processing for export, however internal prices can very quickly drop and with export sales low there is a risk that the internal market gets flooded before exports pick up.

Something is going to have to give, it is hard for us to see Export Sales picking up while Djimmah and Lekempti Minimum Price is 98 c/lb, NY stays between 95 at 115 and Brazil GC is trading at -20 or lower, in addition, demand for Ethiopia coffee from overseas buyers is subdued and the Birr is stable. The only factor keeping ECX prices from dropping is the current internal market price, but for how long! What is manageable by Ethiopian Authorities is the Minimum Price, maybe something will change here?

by Charles Seara Cardoso

Leave a Reply

Want to join the discussion?Feel free to contribute!