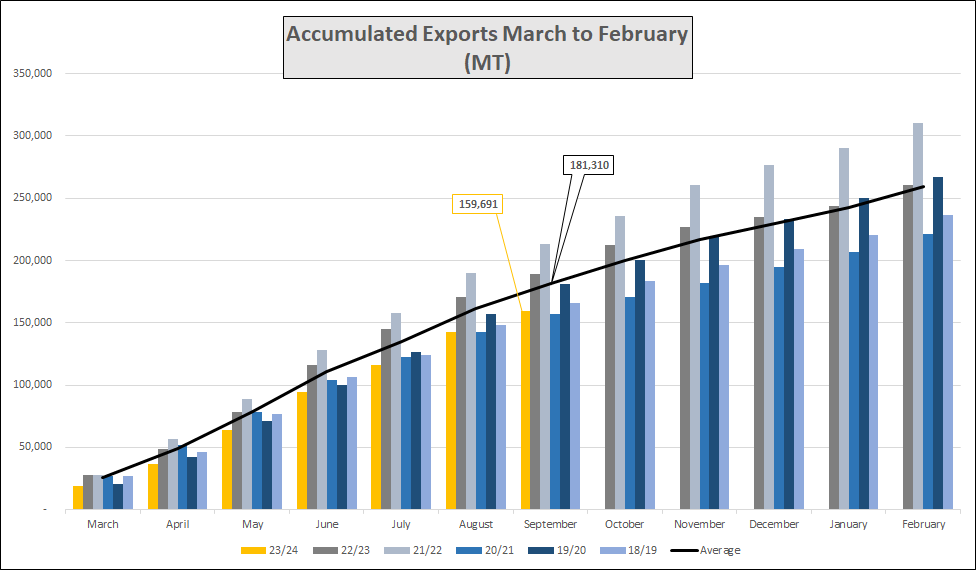

Ethiopia coffee exports reported as 17 k MT bringing the 7 month March to September period to 160 k MT. We are currently 21 k MT below the 5 year average and given that this 23/24 March to Feb period should have been an up year the pace of shipments is very disappointing. We believe that the inventories are at elevated levels across the supply chain, and particularly high at farmer level as a consequence of prices having not met growers expectations. Furthermore, the Coffee & Tea Authority (C&TA) continues to maintain elevated Minimum Registration Prices, particularly for lower quality Grade 5 Naturals discouraging export sales to European markets.

Looking at the coming months we would normally expect shipment flow to decrease between Oct and Feb, given that weakness in the terminal market, poor quality of the coffee remaining in the country and general stubbornness of farmers and the C&TA we expect that exports will remain below potential. I would be surprised if the by the end of the 12 month period (Feb 24) shipments have reached 225 k MT.

Meanwhile harvesting and processing of the 23/24 crop continues, cherry prices remain below 25 Birr/kg (less than half the price paid last year) and given the lack of cash in the field we expect that they will remain contained. Limu areas will start to receive cherries second half October and the Southern regions will start in November.

As a big part of the export market is closed due to high minimum registration prices, local “mercato” coffee prices have decreased due to increased availability of coffee for local consumption. Additionally, crop quality is so poor that the proportion of undergrades is much higher.

Birr 55.35 = USD 1

Have a good weekend.

Leave a Reply

Want to join the discussion?Feel free to contribute!