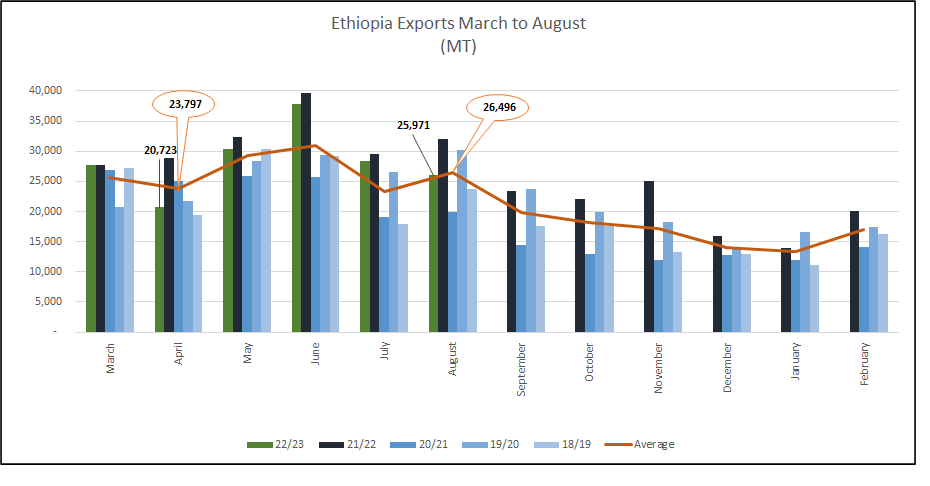

The Harvest is well and truly underway! Washing stations are now open throughout the coffee growing regions. However, many remain closed or operating well below capacity (only opening a few days a week). Lack of financing and high prices are the reasons for this. Cherry prices are all over the place, in Guji prices are around 40 Birr per kg cherry, in Limu we hear 52 Birr per kg cherry and in Yirgacheffe price are as high as 60 Birr per kg cherry. To make commercial sense, washing stations should be buying below 40 Birr per kg, this explains why many shippers are not financing cherry buying, preferring to take their chances at the ECX or buying parchment directly from agrabes once the coffee is ready for milling. If farmers are not able to sell cherries they will dry them on their farms and process Naturals which they will sell later. If more washing stations do not open in late November and December in the Southern regions we shall see a smaller proportion of Washed coffees viz a viz Naturals. More Sidamo 4 less Sidamo 2! Size and quality wise we continue to be optimistic, weather continues to be favourable for harvesting and primary processing.

Current crop offers are well above where they should be (above 300 usc/lb for Sidamo grade 2 and above 185 usc/lb for Djimmah 5), even minimum registration prices are nonsensical:

Sidamo 2 250 usc/lb

Djimmah 5 171 usc/lb

Trading is at a standstill, prices are to high and quality is very poor. Prices in the internal market have decreased but remain above export prices and are therefore increasing quantities of coffee are finding their way to the “mercato”.

For a good synopsis of the current situation on the peace initiative in Ethiopia we recommend this BBC article: https://www.bbc.com/news/world-africa-63503615 and a more update report on the talks on disarmament that are ongoing in Nairobi: https://www.bbc.com/news/live/world-africa-62845587?ns_mchannel=social&ns_source=twitter&ns_campaign=bbc_live&ns_linkname=636a334049d9ef23494b9987%26Ethiopia%20troops%20and%20rebels%20%27share%20food%20and%20cigarettes%27%262022-11-08T13%3A12%3A51.571Z&ns_fee=0&pinned_post_locator=urn:asset:8cab7052-b241-40ca-9b5a-011ee1852992&pinned_post_asset_id=636a334049d9ef23494b9987&pinned_post_type=share

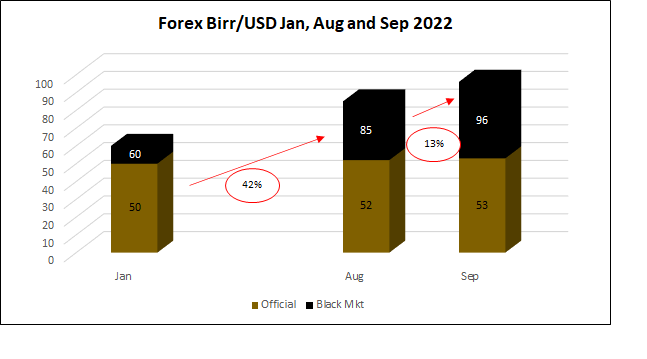

Birr 52.94 = USD 1

Have a good weekend