Whereas the focus of the world this week was on the disastrous fighting in Sudan between opposing factions within that country’s military structure, Ethiopia has not been featured in the news, a sign that the country is at peace and inspite of the drought in certain parts of the country, things are stable.

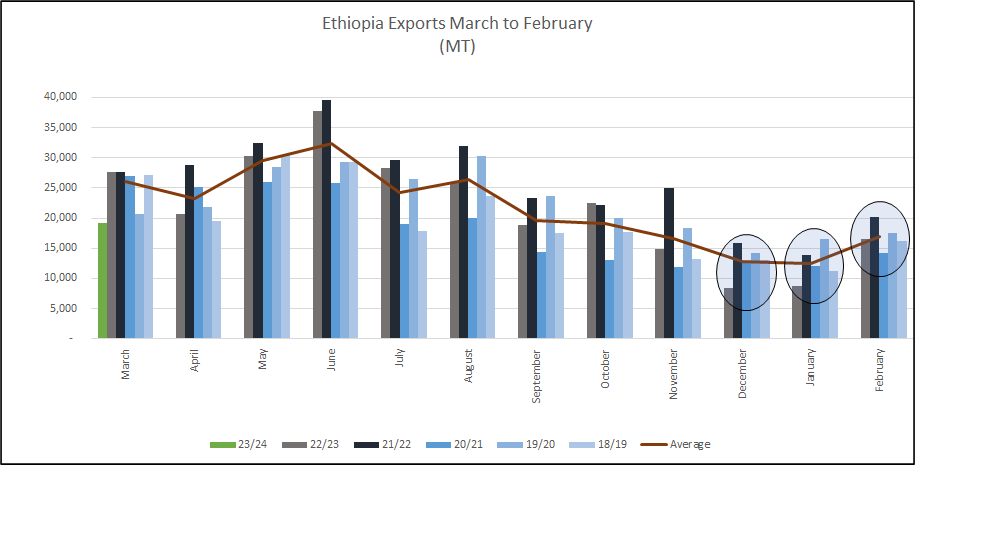

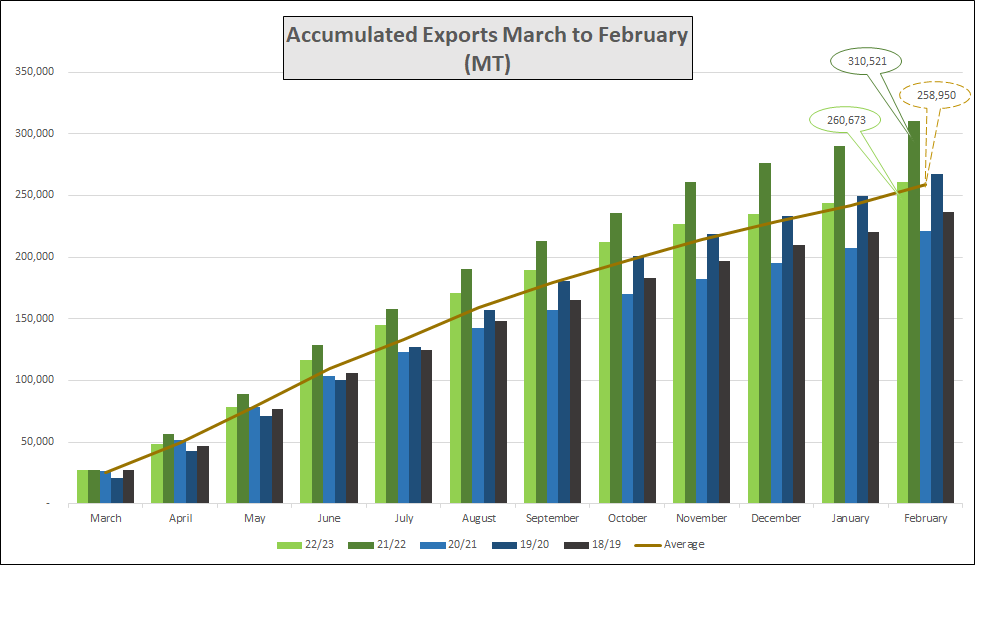

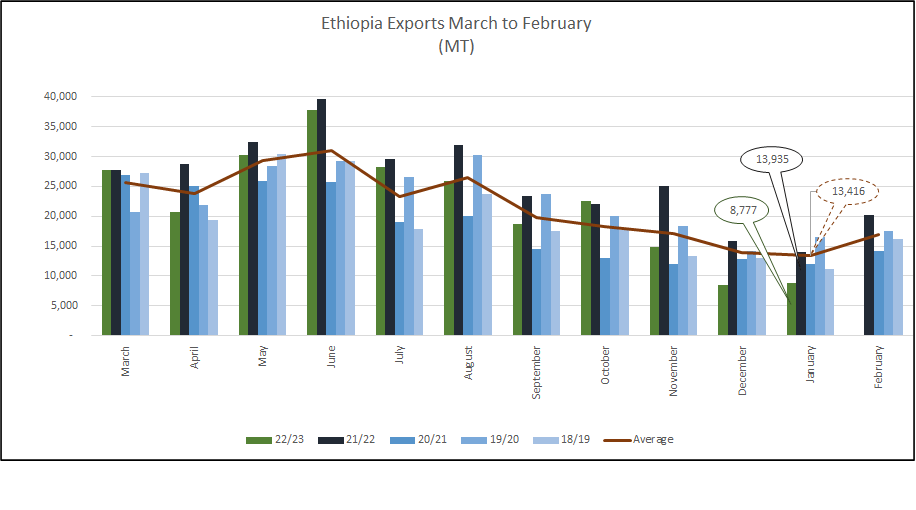

On the coffee front, the buoyant terminal market allowed for some trading even if in a more subdued manner viz a viz last week when the terminal galloped ahead. Shippers are now preparing coffee for shipment, moving stocks to Addis from upcountry and the focus has shifted to execution of commitments rather than selling additional volumes. It will be interesting to see what happens to Grade 5 and 4 FOB differentials for September shipment onwards as New Crop (23/24) Brazil Natural prices are offered at substantial discounts to 22/23 crop offers (for shipments in the next 3 months). Certainly roasters are looking for big discounts in prices, however it is not certain that more usual/normal Ethiopia Natural differentials will be reached this crop. There has been a lot of retention by farmers and agrabes, if they do not like the price they will keep the coffee. This season will see a build up in stocks, after stocks were drawn down in 2021 and to a certain extent in 2022. Shipments will accelerate in the coming months, the recent terminal market moves above 190 c/lb allowed for sales and these will become shipments over the coming 2 to 3 months. The picture for second half of 2023 is murky, the underlying theme seems to be that farmers are selling slowly and consequently stocks are upcountry rather than in Addis.

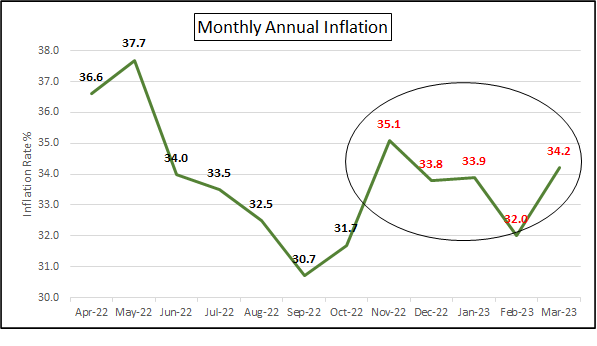

Inflation rate has remained fairly constant over the past few months between 32 and 35%, with food price increases above these rates. Food inflation remains a major reason behind farmers demanding increasing prices for their coffee, farmers do not sell unless their price expectations are met.

Forex 54. 09 = USD 1

Have a good weekend