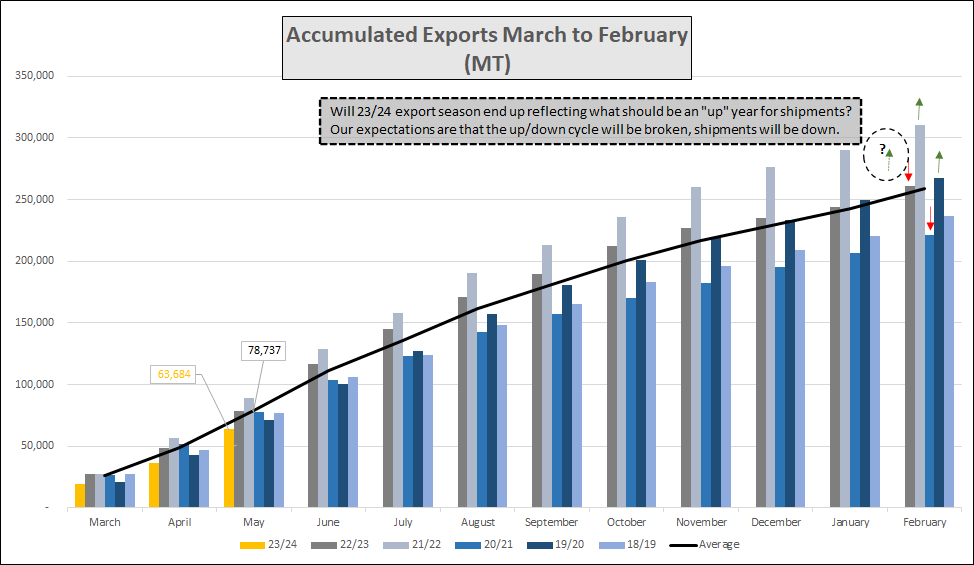

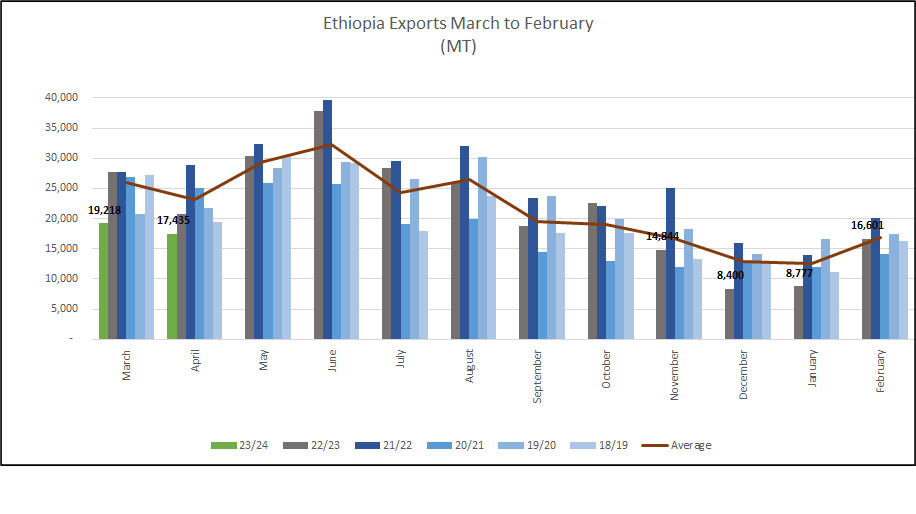

It is not new news, quality of this year’s crop is poor, specifically Grade 5s from Wellega (Lekempti) and Djimmah areas. Furthermore, the wet weather that has plagued the country since March is causing big delays in moving coffee from upcountry to Addis. Stocks in Addis are greatly reduced for this reason plus the additional complications caused by continuous threats by Authorities to tax and penalise shippers that have stocks in Addis. Coffee is moving along the supply chain, however at a painfully slow pace this is being reflected in the very low export figures that we have registered in the last few months. Low shipment figures are likely to continue for remainder of this crop season. Particularly shipments of Naturals to Europe (the main market for Grade 5) on the other hand the Saudi and Middle East markets will absorb increasing volumes of these qualities albeit at lower prices. Ethiopia will have to remain competitive vs Brazil offers which have turned lower has the terminal market decreases. We still believe that there remain reasonable volumes of washed coffees unsold mostly due to high asking prices from shippers which failed to attract buyers.

It continues to rain in Ethiopia, which is normal for this time of year, by all accounts this is beneficial for the upcoming crop that will start to be harvested in September. However the rain continues to hamper the movement of coffee from upcountry to Addis (as mentioned in previous paragraph). Previously delayed shipments are starting to finally reach the port and meet vessels, however the backlog is big and bottlenecks along the supply chain will combine so that the current game of catch-up will be with us for many more weeks!

The BBC reported this week on food shortages in Tigray, a reminder of the legacy of the internal conflict that raged until 2022: https://www.bbc.com/news/world/africa?ns_mchannel=social&ns_source=twitter&ns_campaign=bbc_live&ns_linkname=64a7c1746439480d586b7cca%26Malnutrition%20surges%20with%20Ethiopia%20aid%20suspension%20-%20charity%262023-07-07T07%3A46%3A51.978Z&ns_fee=0&pinned_post_locator=urn:asset:23df806c-cc2d-4180-9b94-560c8137303f&pinned_post_asset_id=64a7c1746439480d586b7cca&pinned_post_type=share

Birr 54.64 = USD 1

Have a good weekend.

Regards