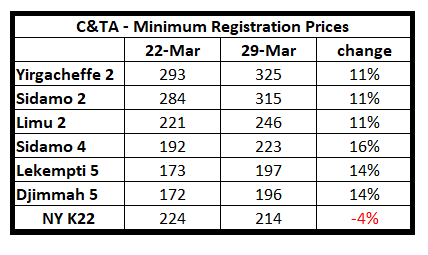

In a rather bizarre twist, the Coffee & Tea Authority decided this week to increase considerably the Minimum Registration Prices. Why would you do that in a declining terminal market? Minimum registration prices have been irrelevant in the past few months as bids, offers and traded levels far exceeded these. However with the recent decline in terminal levels, the usual brisk trading activity for this time of the year has greatly reduced, asking prices have been above levels that buyers are prepared to pay. Naturally sales registration in March were low, so why increase the minimum price that you can register a sale? Furthermore, shippers´ warehouses are full of parchment that remains mostly unsold and increasing the price that coffee can trade is hardly going to improve trading…

Below the minimum registration prices and NY close for day before publishing the weekly minimum registration price:

A severe consequence of draught and war is famine and this seriously affecting the population in the North of country, the BBC report: https://www.bbc.com/news/world-africa-60861900

Birr 50.99 USD = 1

Have a good weekend