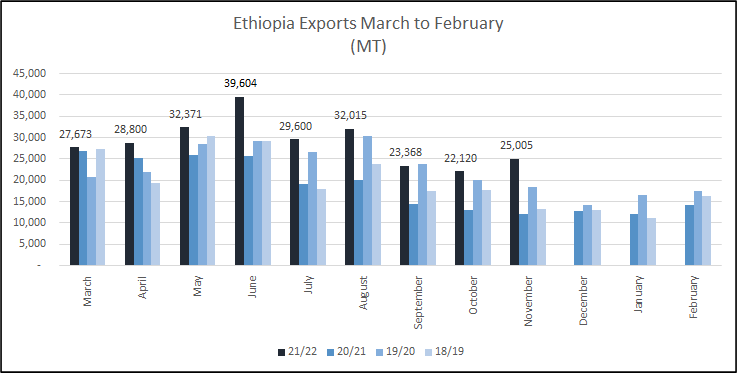

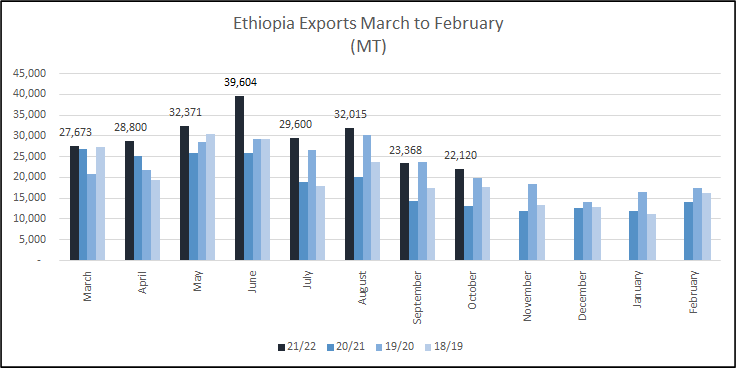

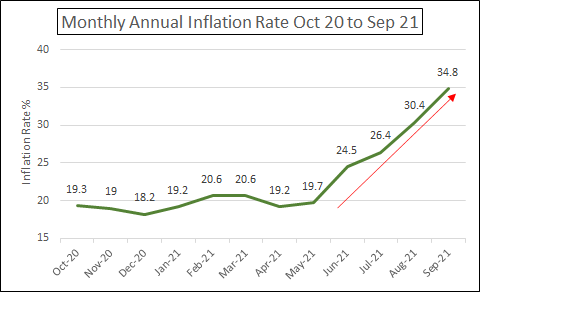

As a consequence of last week’s Central Bank decision to reduce the proportion of USD that shippers can utilise from their coffees export earnings to pay for imported goods and services, shippers are less ready to reduce margins on coffee sales and have increased prices to better reflect the high prices being paid to farmers for cherries. So it will come as no surprise to know that trading has been slow, slower than expected for this time of the year. The trade is struggling to book Sidamo 2 at replacement differentials, having to heavily discount the price to get anything sold to roasters. This could prove to be costly as we are seeing more and more evidence that Washed coffee production in the South will be significantly lower in 21/22 than in 20/21.

In 2 weeks’ time agrabes will be able to start the trade in Natural Coffees and all stakeholders will have a clearer picture of where we can expect grade 4 and 5 coffees to trade. For now shippers are reluctant to offer aggressively fearful that the high price Washed coffee scenario will be repeated when the Natural coffee trading really gets going in earnest. There is demand for Ethiopia coffee but the price has to be inline with coffees from other origins of similar quality. Since we are expecting a higher production of Naturals this year it is more likely that the price for Ethiopian Naturals adjusts more readily to the international market than what we have been experiencing in Washed coffees so far this season, which have, so far, consistently been offered at high differentials.

The United Nations Secretary-General gave an interview to the BBC expressing hope for dialogue between the waring parties in Ethiopia, pls follow the link to watch: https://www.bbc.com/news/av-embeds/60076161

The local currency is still below 50 to the greenback, but only just! Birr 49.60 = USD 1