Fighting is intensifying in the Northern part of the country, with rebel Tigray forces taking several towns from the National Army in Amhara region. Of concern to the Government will be reports that the rebels are moving Southwards in the direction of Addis Ababa and that they are now 350 km North of the capital. The BBC has several reports including the USA government’s reaction to the latest reports of rebels advances.

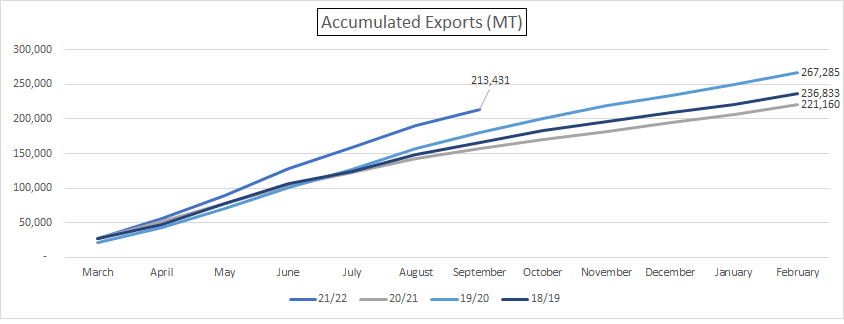

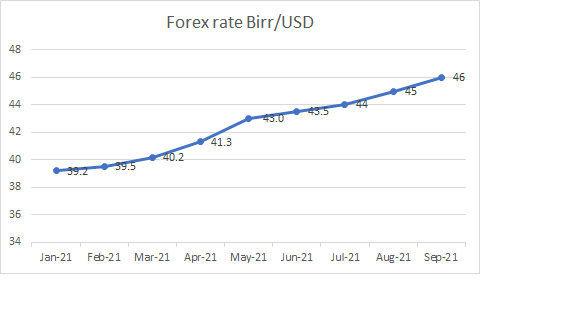

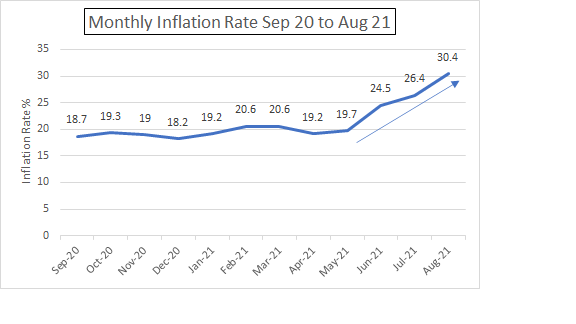

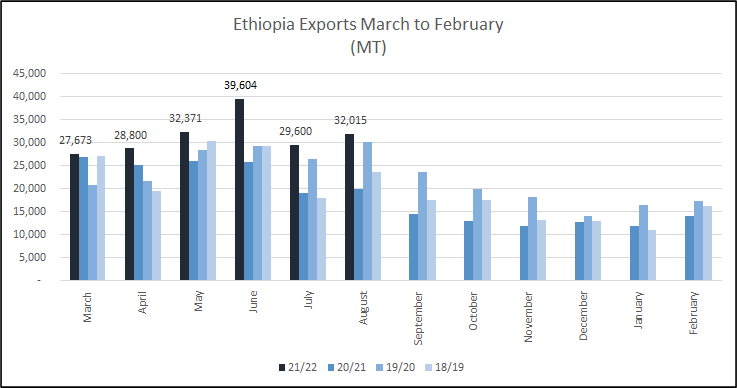

It nearly seems inappropriate to discuss the arrival of the New Crop to market at this time of political instability and fighting, but that is what we need to do. The first arrivals from Tepi and Benchi Maji have started to reach the ECX and slowly but surely more coffee growing regions will start harvesting. Cherry prices converted to USD are higher than last year and these tend to increase over the harvest period as competition among agrabes intensifies. This season the aforementioned political instability and more restrictive financing environment might diminish pressures at farmgate level, time will tell. What is likely, given the ongoing devaluation of the local currency vs the greenback and the higher terminal market this year, is that cherry prices in Birr will be the highest ever paid.

Birr 47.22 = USD 1

Have a good week.