All

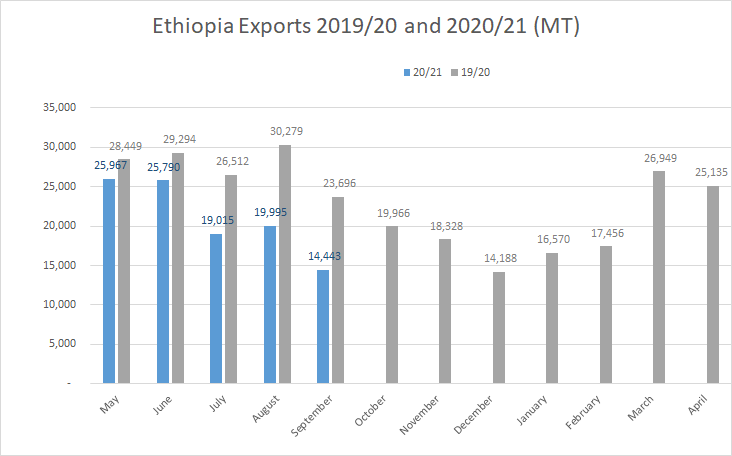

For the first time ever there is no Lekempti coffee and only 150MT of Djimmah coffee in ECX warehouses waiting to be sold, in total only 500 MT of Naturals are waiting to be sold at ECX warehouses. The reason is clear, agrabes will not bring coffee to the market while price ceilings are in place, this impasse has to be resolved soon or the pace of shipments will continue at the very low levels of recent months or fall even further. Furthermore, the National Bank of Ethiopia has stopped allowing registration of 2019/2020 crop coffee which had lower Minimum Registration prices than 2020/21 crop coffee so unless the NY market rallies strongly we see registrations for Washed coffees also stopping since there is little appetite for Sidamo 2 or Yirgacheffe 2 at around +100 FOB.

The Government forces continued their offensive against the leadership of Tigray region forces adding more victories to the initial taking control of the northern region territory. Tensions with neighbouring Sudan continue but little fallout to report.

Birr 39.33 = USD 1

Have a great weekend