All

Ethiopian Electoral Board announced a postponement of the ballot originally being held on June 5th. No new date has been given since the oficial issues behind this decision, slow voter registration, delays in training polling station staff and supply of ballot papers have not been overcome! The extreme insecurity in different parts of the country are a very strong reason not to hold the ballot at present and until resolved will continue to hamper efforts to forge forward with planning for the ballot. In Tigray region all plans to hold the poll had already been abandoned, however instances of violence in other parts of Ethiopia continue to occur and impede normal daily life.

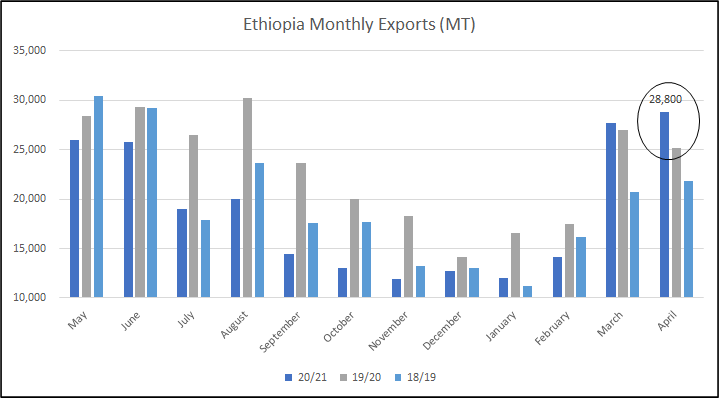

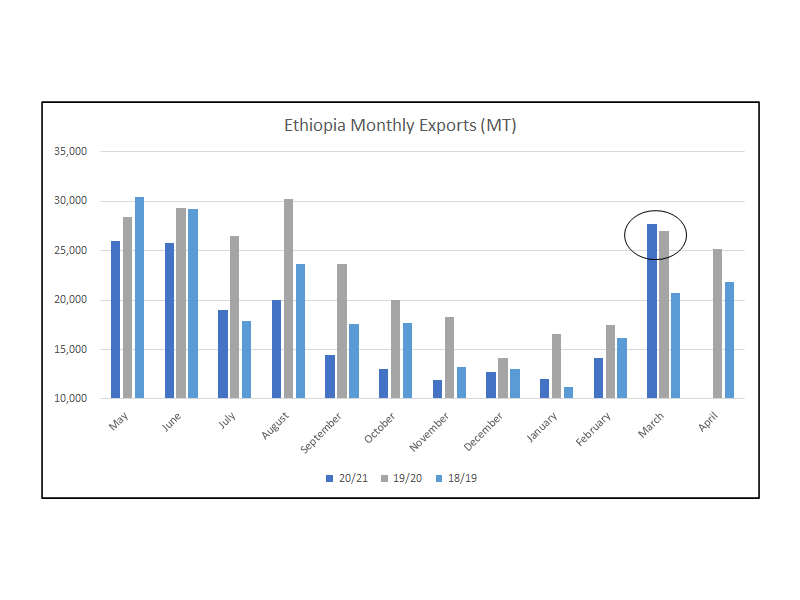

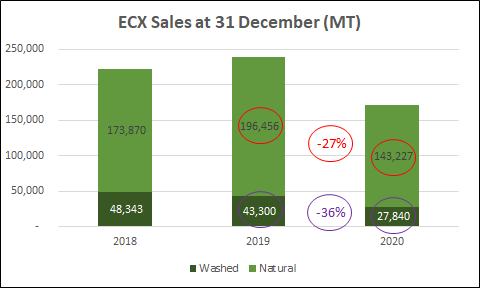

Meanwhile in Addis, coffee mills are full and working at capacity churning out coffee for Export; the usual logistical constraints, lack of containers, changing vessel schedules and equipment breakdowns hamper efforts to get coffee on vessels. Having said this, we continue to expect Export figures to remain at very high levels as a combination of attractive prices and a bumper crop “push” coffee on to vessels!

Overseas buyers appear to have an insatiable appetite, Ethiopian coffee inquiries do not stop coming and business continues to be concluded; Ethiopia Washed Coffees are increasingly competitive vs coffees from other Origins, as Ethiopian Naturals have been vs Brazil. At this rate, carry out stocks are likely to be small this year across the full quality spectrum.

Minimum registration prices for Washed coffees were set lower this week, a clear sign that the Coffee and Tea Authority (C&TA) is in misteep with both the NY Terminal Market and overseas demand for these coffees.

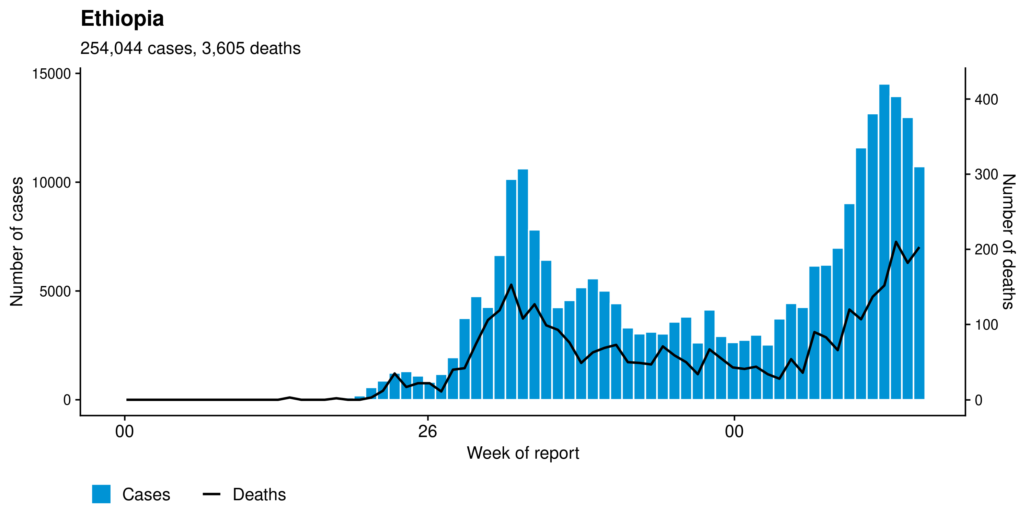

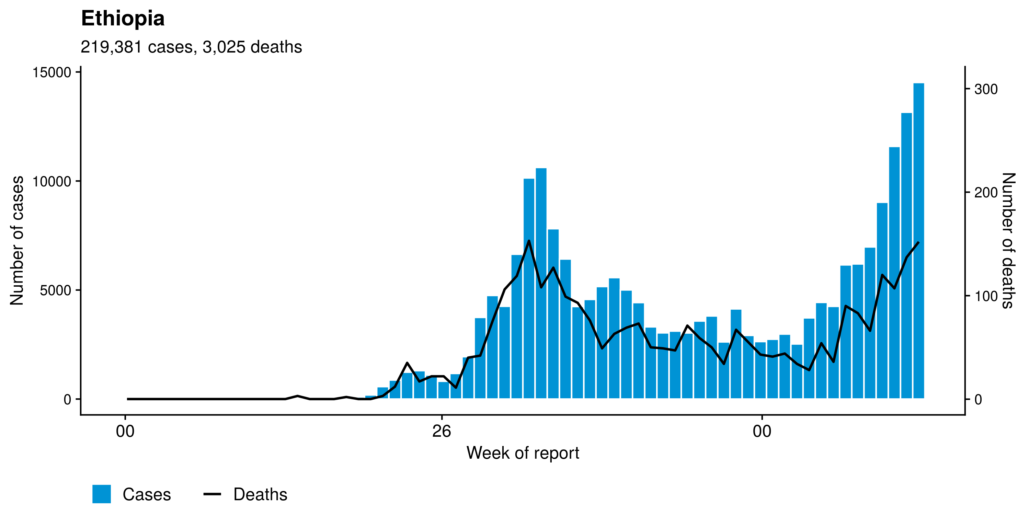

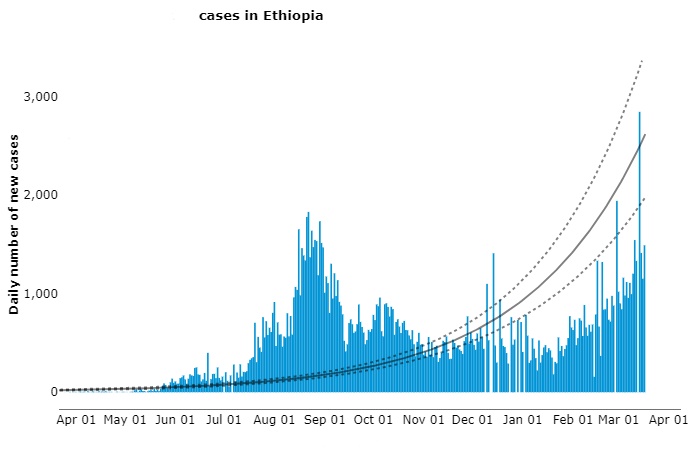

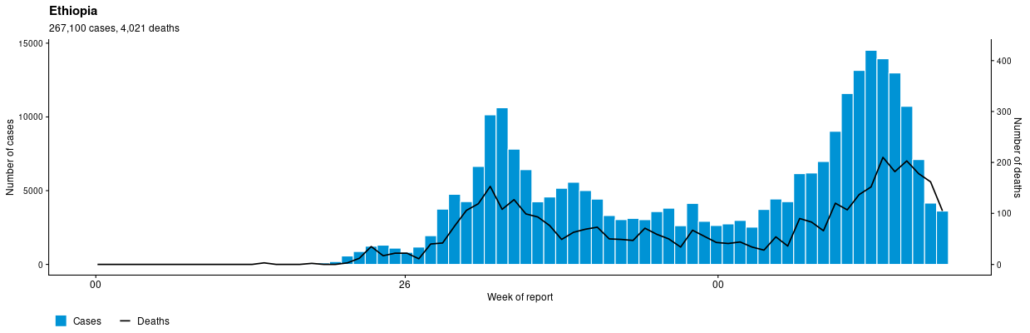

Now some good news, Covid cases and associated deaths continue to decline. Nearly 1.5 Million doses of the vaccine have been administered.

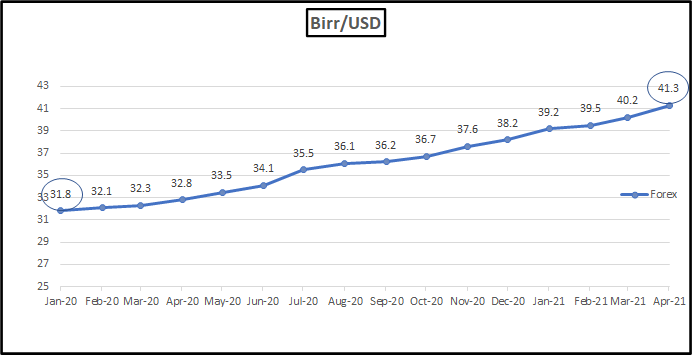

Birr 42.70 = USD 1

Have a nice weekend.