All

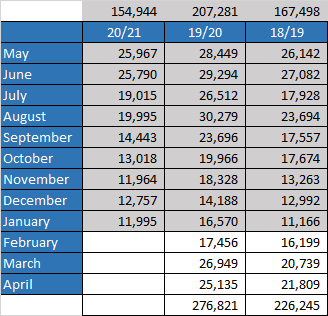

The Government remains concerned about the slow pace of exports; the export figures for February, continue to perpetuate the slow-paced trend of the last 8 months and confirm the lower production in 2019/20. The higher crop figure 2020/21 still not being translated into higher exports. For now we remain at 75% of the previous year’s exports (for the 10 Months May to Feb), however 20/21 pace is starting to accelerate, in Feb 2021 exports were 80% of the 2020 Feb exports. We expect that this will continue, and by May 21 monthly exports should be above the 2020 monthly figures. For this to materialise we need the authorities to reduce Minimum Export Prices for registration purposes for Washed coffees, particularly for Sidamo 2. However, we are not going to reach 4 M bags exports during the May 20/April 21 period and will record around a 20-25% drop in exports vs the previous 12 month period 19/20. In fact we are looking at the lowest export figures in the last 5 years!

Registered Sales’ volumes for the last week in February and 1st week in March were very high, particularly Naturals (grades 4 and 5); since then shippers have been focusing on buying grade 4 and 5 coffee to fulfil these commitments. Volumes at ECX are increasing as a consequence of prices having been allowed to increase. Quality wise, our expectations for improvements versus the previous crop are materialising. We look forward to better quality, less defects in the green and cup, as the season moves on.

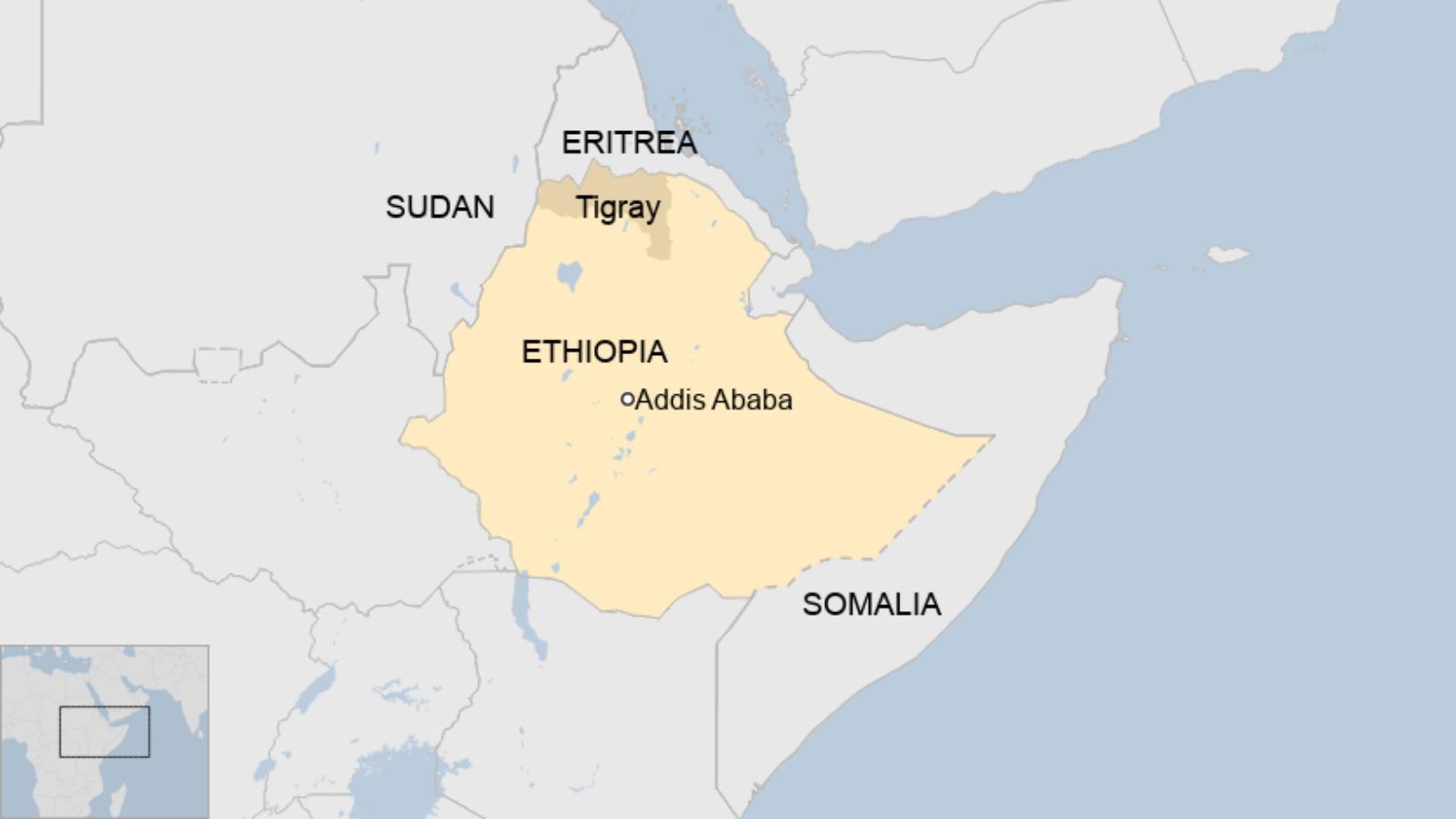

On the political front things are a little complicated for the country’s leadership. Following a visit to the Tigray region, the US Ambassador to the country called for an independent investigation to verify the genocide allegations being levied on the Government and its allied forces. This is a developing story and could have more far fetching implications for the Government and the country.

Birr 40.20 = USD 1

Have a good weekend.